Which Film Was The First To Feature A Photo-Realistic Computer-Generated Character? |

|

Think you know the answer? |

|

from How-To Geek https://ift.tt/2S59cDt

Which Film Was The First To Feature A Photo-Realistic Computer-Generated Character? |

|

Think you know the answer? |

|

![]() Wall Street Journal:

Wall Street Journal:

A look at traditional auto makers' attempts to reimagine themselves as software and service companies, in order to fend off rivals like Uber and Waymo — As IPO proposals value Uber at an eye-popping $120 billion, auto makers are racing to gain ground in everything from car sharing to driverless technology.

![]() Sue Halpern / New Republic:

Sue Halpern / New Republic:

How political data firms continue to vacuum up psychological and personal data on people in order to sway voters, even after the Cambridge Analytica scandal — In April, when the Senate Judiciary and Commerce committees summoned Facebook CEO Mark Zuckerberg to Washington …

![]() Triplebyte Blog:

Triplebyte Blog:

Interview with YC partner Paul Buchheit about how he got started with programming, joining Google and creating Gmail, becoming a great engineer, and more — On Becoming a Programmer … One moment I remember really getting into programming came while playing a fantasy RPG video game.

![]() Jake Swearingen / New York Magazine:

Jake Swearingen / New York Magazine:

Joshua Schachter on inventing tags for bookmarks, selling Del.icio.us to Yahoo in 2005, and Yahoo's mismanagement of the service before its 2017 shutdown — As told to , Jake Swearingen @JakeSwearingen — Joshua Schachter's groundbreaking social-bookmarking site Del.icio.us, founded in 2003 …

![]() Fast Company:

Fast Company:

Many of the economists who testified at FTC hearings this week and dismissed or criticized the idea of tech monopolies, received money from big tech in the past — Amid growing concern over the power of such behemoths as Amazon, Google, Facebook, and other tech giants …

![]() Lindsey O'Donnell / Threatpost:

Lindsey O'Donnell / Threatpost:

Researcher discovers, helps patch 13 vulnerabilities in open source IoT OS FreeRTOS and Amazon's AWS secure connectivity modules using the OS — Researchers have found that a popular Internet of Things real-time operating system - FreeRTOS - is riddled with serious vulnerabilities.

![]() New York Times:

New York Times:

A look at apps like Cruz Crew, N.R.A. and Great America that offer conservatives safe spaces free from the content guidelines of big platforms like Facebook — Imagine a society in which everyone more or less agrees with you. — You wake up in the morning to online greetings from people …

![]() Ian Cutress / AnandTech:

Ian Cutress / AnandTech:

Review of Intel 9th Gen CPUs: best gaming CPUs if money is no object, but for tasks where GPU is the bottleneck, older Intel or AMD chips are a wiser choice — Intel's newest line of desktop processors bring with them a number of changes designed to sway favor with performance enthusiasts.

![]() Issie Lapowsky / Wired:

Issie Lapowsky / Wired:

Interview with Brian Amerige, the former Facebook employee whose memo accusing the company of being a political monoculture led to fierce internal debate — AT ONE POINT this summer, Brian Amerige seemed destined to become the next James Damore. — Like Damore, the Google engineer who wrote …

![]() Jordan Novet / CNBC:

Jordan Novet / CNBC:

SEC filing: Microsoft now includes LinkedIn performance metrics, like the number of active users, in calculating stock awards to four top execs, including CEO — - Microsoft paid $27 billion for LinkedIn in 2016 and is now tying its performance to executive pay.

An explosive report in The New York Times this weekend sheds new light on the apparent targeting of Twitter accounts by “state-sponsored actors” three years ago.

It comes in the wake of the confirmed death of Washington Post journalist Jamal Khashoggi on Friday, two weeks after he disappeared in the Saudi consulate in Istanbul. Khashoggi had long been a target of a Saudi troll army, according to the report, which employed hundreds of people to stifle the speech of government critics, like Khashoggi, who left the kingdom to live and work in the United States.

But the troll farm is said to be one part of a wider scheme by the Saudi leadership to surveil critics and dissidents.

According to the report, Western intelligence officials told Twitter that one of its employees, a Saudi national, was asked by the Saudi government to spy on the accounts of dissidents. The employee — an engineer — had access to account data on Twitter users, including phone numbers and IP addresses. Saudi officials are said to have convinced him to snoop on several accounts. Twitter fired the employee, despite finding no evidence that he handed data over to the Saudi government. The employee later returned to the kingdom and now works for its government.

After the dismissal, the Times reports, Twitter sent out warnings a few dozen users that their accounts “may have been targeted by state-sponsored actors.”

“As a precaution, we are alerting you that your Twitter account is one of a small group of accounts that may have been targeted by state-sponsored actors,” said Twitter in the email to affected users. “We believe that these actors (possibly associated with a government) may have been trying to obtain information such as email addresses, IP addresses, and/or phone numbers.”

Twitter didn’t say at the time what was the cause of the email warning, leading some to question what linked the affected accounts.

Around 20 users were affected, including privacy and security researcher Runa Sandvik, human rights activist Michael Carbone, and Austrian communications expert Marco Schreuder.

Several of the affected users also worked for the Tor Project, a non-profit that allows activists and researchers to browse the web anonymously — often to bypass state-level censorship and surveillance.

Facebook and Google also have similar alerts in place in the event of suspected state-sponsored attacks or hacking, though often the companies send out alerts out of an abundance of caution — rather than a solid indicator that an account has been breached.

Twitter did not respond to a request for comment.

Silicon Valley is in the midst of a health craze, and it is being driven by “Eastern” medicine.

It’s been a record year for US medical investing, but investors in Beijing and Shanghai are now increasingly leading the largest deals for US life science and biotech companies. In fact, Chinese venture firms have invested more this year into life science and biotech in the US than they have back home, providing financing for over 300 US-based companies, per Pitchbook. That’s the story at Viela Bio, a Maryland-based company exploring treatments for inflammation and autoimmune diseases, which raised a $250 million Series A led by three Chinese firms.

Chinese capital’s newfound appetite also flows into the mainland. Business is booming for Chinese medical startups, who are also seeing the strongest year of venture investment ever, with over one hundred companies receiving $4 billion in investment.

As Chinese investors continue to shift their strategies towards life science and biotech, China is emphatically positioning itself to be a leader in medical investing with a growing influence on the world’s future major health institutions.

We like to talk about things we can interact with or be entertained by. And so as nine-figure checks flow in and out of China with stunning regularity, we fixate on the internet giants, the gaming leaders or the latest media platform backed by Tencent or Alibaba.

However, if we follow the money, it’s clear that the top venture firms in China have actually been turning their focus towards the country’s deficient health system.

A clear leader in China’s strategy shift has been Sequoia Capital China, one of the country’s most heralded venture firms tied to multiple billion-dollar IPOs just this year.

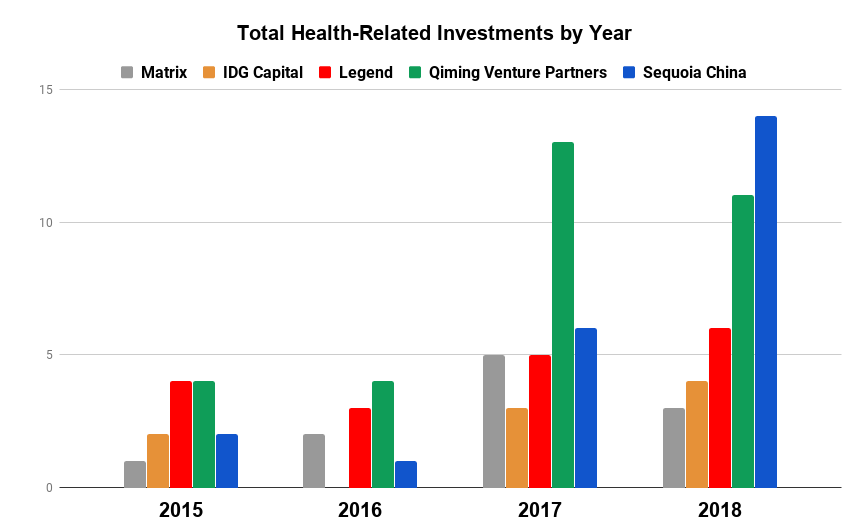

Historically, Sequoia didn’t have much interest in the medical sector. Health was one of the firm’s smallest investment categories, and it participated in only three health-related deals from 2015-16, making up just 4% of its total investing activity.

Recently, however, life sciences have piqued Sequoia’s fascination, confirms a spokesperson with the firm. Sequoia dove into six health-related deals in 2017 and has already participated in 14 in 2018 so far. The firm now sits among the most active health investors in China and the medical sector has become its second biggest investment area, with life science and biotech companies accounting for nearly 30% of its investing activity in recent years.

Health-related investment data for 2015-18 compiled from Pitchbook, Crunchbase, and SEC Edgar

There’s no shortage of areas in need of transformation within Chinese medical care, and a wide range of strategies are being employed by China’s VCs. While some investors hope to address influenza, others are focused on innovative treatments for hypertension, diabetes and other chronic diseases.

For instance, according to the Chinese Journal of Cancer, in 2015, 36% of world’s lung cancer diagnoses came from China, yet the country’s cancer survival rate was 17% below the global average. Sequoia has set its sights on tackling China’s high rate of cancer and its low survival rate, with roughly 70% of its deals in the past two years focusing on cancer detection and treatment.

That is driven in part by investments like the firm’s $90 million Series A investment into Shanghai-based JW Therapeutics, a company developing innovative immunotherapy cancer treatments. The company is a quintessential example of how Chinese VCs are building the country’s next set of health startups using their international footprints and learnings from across the globe.

Founded as a joint-venture offshoot between US-based Juno Therapeutics and China’s WuXi AppTec, JW benefits from Juno’s experience as a top developer of cancer immunotherapy drugs, as well as WuXi’s expertise as one of the world’s leading contract research organizations, focusing on all aspects of the drug R&D and development cycle.

Specifically, JW is focused on the next-generation of cell-based immunotherapy cancer treatments using chimeric antigen receptor T-cell (CAR-T) technologies. (Yeah…I know…) For the WebMD warriors and the rest of us with a medical background that stopped at tenth-grade chemistry, CAR-T essentially looks to attack cancer cells by utilizing the body’s own immune system.

Past waves of biotech startups often focused on other immunologic treatments that used genetically-modified antibodies created in animals. The antibodies would effectively act as “police,” identifying and attaching to “bad guy” targets in order to turn off or quiet down malignant cells. CAR-T looks instead to modify the body’s native immune cells to attack and kill the bad guys directly.

Chinese VCs are investing in a wide range of innovative life science and biotech startups. (Photo by Eugeneonline via Getty Images)

The international and interdisciplinary pedigree of China’s new medical leaders not only applies to the organizations themselves but also to those running the show.

At the helm of JW sits James Li. In a past life, the co-founder and CEO held stints as an executive heading up operations in China for the world’s biggest biopharmaceutical companies including Amgen and Merck. Li was also once a partner at the Silicon Valley brand-name investor, Kleiner Perkins.

JW embodies the benefits that can come from importing insights and expertise, a practice that will come to define the companies leading the medical future as the country’s smartest capital increasingly finds its way overseas.

Despite heavy investment by China’s leading VCs, Silicon Valley is doubling down in the US health sector. (AFP PHOTO / POOL / JASON LEE)

Innovation in medicine transcends borders. Sickness and death are unfortunately universal, and groundbreaking discoveries in one country can save lives in the rest.

The boom in China’s life science industry has left valuations lofty and cross-border investment and import regulations in China have improved.

As such, Chinese venture firms are now increasingly searching for innovation abroad, looking to capitalize on expanding opportunities in the more mature US medical industry that can offer innovative technologies and advanced processes that can be brought back to the East.

In April, Qiming Venture Partners, another Chinese venture titan, closed a $120 million fund focused on early-stage US healthcare. Qiming has been ramping up its participation in the medical space, investing in 24 companies over the 2017-18 period.

New firms diving into the space hasn’t frightened the Bay Area’s notable investors, who have doubled down in the US medical space alongside their Chinese counterparts.

Partner directories for America’s most influential firms are increasingly populated with former doctors and medically-versed VCs who can find the best medical startups and have a growing influence on the flow of venture dollars in the US.

At the top of the list is Krishna Yeshwant, the GV (formerly Google Ventures) general partner leading the firm’s aggressive push into the medical industry.

Krishna Yeshwant (GV) at TechCrunch Disrupt NY 2017

A doctor by trade, Yeshwant’s interest runs the gamut of the medical spectrum, leading investments focusing on anything from real-time patient care insights to antibody and therapeutic technologies for cancer and neurodegenerative disorders.

Per data from Pitchbook and Crunchbase, Krishna has been GV’s most active partner over the past two years, participating in deals that total over a billion dollars in aggregate funding.

Backed by the efforts of Yeshwant and select others, the medical industry has become one of the most prominent investment areas for Google’s venture capital arm, driving roughly 30% of its investments in 2017 compared to just under 15% in 2015.

GV’s affinity for medical-investing has found renewed life, but life science is also part of the firm’s DNA. Like many brand-name Valley investors, GV founder Bill Maris has long held a passion for the health startups. After leaving GV in 2016, Maris launched his own fund, Section 32, focused specifically on biotech, healthcare and life sciences.

In the same vein, life science and health investing has been part of the lifeblood for some major US funds including Founders Fund, which has consistently dedicated over 25% of its deployed capital to the space since at least 2015.

The tides may be changing, however, as the recent expansion of oversight for the Committee on Foreign Investment in the United States (CFIUS) may severely impact the flow of Chinese capital into areas of the US health sector.

Under its extended purview, CFIUS will review – and possibly block – any investment or transaction involving a foreign entity related to the production, design or testing of technology that falls under a list of 27 critical industries, including biotech research and development.

The true implications of the expanded rules will depend on how aggressively and how often CFIUS exercises its power. But a lengthy review process and the threat of regulatory blocks may significantly increase the burden on Chinese investors, effectively shutting off the Chinese money spigot.

Regardless of CFIUS, while China’s active presence in the US health markets hasn’t deterred Valley mainstays, with a severely broken health system and an improved investment environment backed by government support, China’s commitment to medical innovation is only getting stronger.

Deficiencies in China’s health sector has historically led to troublesome outcomes. Now the government is jump-starting investment through supportive policy. (Photo by Alexander Tessmer / EyeEm via Getty Images)

They say successful startups identify real problems that need solving. Marred with inefficiencies, poor results, and compounding consumer frustration, China’s health industry has many.

Outside of a wealthy few, citizens are forced to make often lengthy treks to overcrowded and understaffed hospitals in urban centers. Reception areas exist only in concept, as any open space is quickly filled by hordes of the concerned, sick, and fearful settling in for wait times that can last multiple days.

If and when patients are finally seen, they are frequently met by overworked or inexperienced medical staff, rushing to get people in and out in hopes of servicing the endless line behind them.

Historically, when patients were diagnosed, treatment options were limited and ineffective, as import laws and affordability issues made many globally approved drugs unavailable.

As one would assume, poor detection and treatment have led to problematic outcomes. Heart disease, stroke, diabetes and chronic lung disease accounts for 80% of deaths in China, according to a recent report from the World Bank.

Recurring issues of misconduct, deception and dishonesty have amplified the population’s mounting frustration.

After past cases of widespread sickness caused by improperly handled vaccinations, China’s vaccine crisis reached a breaking point earlier this year. It was revealed that 250,000 children had been given defective and fallacious rabies vaccinations, a fact that inspectors had discovered months prior and swept under the rug.

Fracturing public trust around medical treatment has serious, potentially destabilizing effects. And with deficiencies permeating nearly all aspects of China’s health and medical infrastructure, there is a gaping set of opportunities for disruptive change.

In response to these issues, China’s government placed more emphasis on the search for medical innovation by rolling out policies that improve the chances of success for health startups, while reducing costs and risk for investors.

Billions of public investment flooded into the life science sector, and easier approval processes for patents, research grants, and generic drugs, suddenly made the prospect of building a life science or biotech company in China less daunting.

For Chinese venture capitalists, on top of financial incentives and a higher-growth local medical sector, loosening of drug import laws opened up opportunities to improve China’s medical system through innovation abroad.

Liquidity has also improved due to swelling global interest in healthcare. Plus, the Hong Kong Stock Exchange recently announced changes to allow the listing of pre-revenue biotech companies.

The changes implemented across China’s major institutions have effectively provided Chinese health investors with a much broader opportunity set, faster growth companies, faster liquidity, and increased certainty, all at lower cost.

However, while the structural and regulatory changes in China’s healthcare system has led to more medical startups with more growth, it hasn’t necessarily driven quality.

US and Western investors haven’t taken the same cross-border approach as their peers in Beijing. From talking with those in the industry, the laxity of the Chinese system, and others, have made many US investors weary of investing in life science companies overseas.

And with the Valley similarly stepping up its focus on startups that sprout from the strong American university system, bubbling valuations have started to raise concern.

But with China dedicating more and more billions across the globe, the country is determined to patch the massive holes in its medical system and establish itself as the next leader in international health innovation.

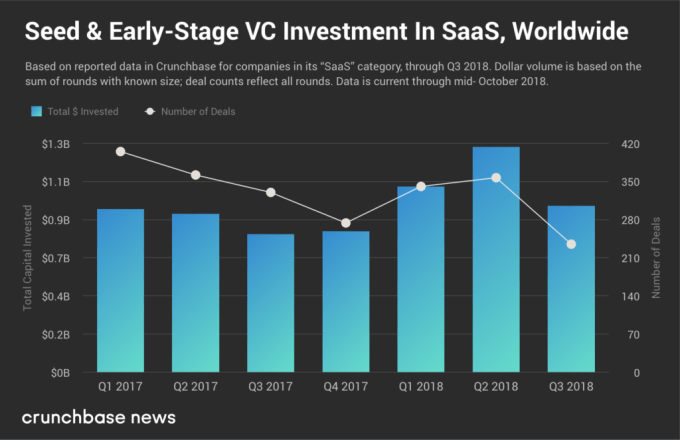

A few months ago, Crunchbase News reported that a longstanding period of SaaS investment stagnation had come to an end.

However, the investment boom times didn’t necessarily carry over to the seed and early-stage end of the subscription software businesses.

The chart below displays deal and dollar volume of seed and early-stage venture investments1 made into companies from around the world in Crunchbase’s SaaS category. Note that it is subject to historically documented reporting delays, which are most pronounced in seed and early-stage deals.

As can be plainly seen that Q3 2018 took quite a turn in terms of investment into SaaS. And it’s a bit bewildering as to why.

Overall, the venture market in Q3 hit record heights, and nearly every stage of investment saw more dollars and more rounds. Yet, as shown above, SaaS startups don’t appear to be beneficiaries of this influx of cash.

The picture becomes even more distorted when we account for public market SaaS comps, which set the benchmark for private companies. And that benchmark hasn’t been suffering. Public cloud companies have enjoyed a steep run up in asset value over the past several years.

The newly revamped BVP Nasdaq Emerging Cloud Index (formerly known as the Bessemer Cloud Index) tracks a basket of publicly traded SaaS stocks, including the likes of Salesforce, Adobe and more recent debuts like Dropbox, DocuSign and Okta, among others.

Public companies in the Bessemer Cloud Index grew their public valuations much faster than more broad-based indices like the Dow Jones Industrial Average and the S&P 500. Carried by the high and still-growing value of recurring revenue, warm reception of SaaS companies new to public markets and (with the exception of the past couple of weeks) generally stable markets overall, public SaaS companies have done well. Despite a pretty absurd rate of growth on the public side, no such consistent growth could be found on the early-stage, private end of the market.

However, rather than viewing Q3 2018 as a disappointment for the early-stage SaaS investment market, it’s more like a reversion to the mean. It’s the first half of the year that’s the outlier, not Q3.

The first half of 2018 had some truly huge early-stage deals cross the wires. In March, Robotic process automation software company UiPath raised $153 million in its Series B. (UiPath just raised another $225 million in a Series C round in September.) Collaborative email inbox Front App raised $66 million in its January Series B. Rival Chicago logistics software companies FourKites and project44 each raised $35 million Series B rounds earlier in the year. On a one-off basis, these are big rounds, but collectively they add up to a huge pile of money.

The conclusion we’re drawn to here is that we were perhaps premature in declaring the long-time downtrend snapped to the upside.

It’s been over five years since NSA whistleblower Edward Snowden lifted the lid on government mass surveillance programs, revealing, in unprecedented detail, quite how deep the rabbit hole goes thanks to the spread of commercial software and connectivity enabling a bottomless intelligence-gathering philosophy of ‘bag it all’.

Yet technology’s onward march has hardly broken its stride.

Government spying practices are perhaps more scrutinized, as a result of awkward questions about out-of-date legal oversight regimes. Though whether the resulting legislative updates, putting an official stamp of approval on bulk and/or warrantless collection as a state spying tool, have put Snowden’s ethical concerns to bed seems doubtful — albeit, it depends on who you ask.

The UK’s post-Snowden Investigatory Powers Act continues to face legal challenges. And the government has been forced by the courts to unpick some of the powers it helped itself to vis-à-vis people’s data. But bulk collection, as an official modus operandi, has been both avowed and embraced by the state.

In the US, too, lawmakers elected to push aside controversy over a legal loophole that provides intelligence agencies with a means for the warrantless surveillance of American citizens — re-stamping Section 702 of FISA for another six years. So of course they haven’t cared a fig for non-US citizens’ privacy either.

Increasingly powerful state surveillance is seemingly here to stay, with or without adequately robust oversight. And commercial use of strong encryption remains under attack from governments.

But there’s another end to the surveillance telescope. As I wrote five years ago, those who watch us can expect to be — and indeed are being — increasingly closely watched themselves as the lens gets turned on them:

“Just as our digital interactions and online behaviour can be tracked, parsed and analysed for problematic patterns, pertinent keywords and suspicious connections, so too can the behaviour of governments. Technology is a double-edged sword – which means it’s also capable of lifting the lid on the machinery of power-holding institutions like never before.”

We’re now seeing some of the impacts of this surveillance technology cutting both ways.

Tech-enabled exposés revealing the modus operandi of brutal regimes — e.g. @bellingcat IDing the GRU agents who poisoned the Skripals or Turkish surveillance leaking graphic details of Khashoggi's fate — keep reminding me of this piece I wrote 5yrs ago https://t.co/CTGUf956s7

— Natasha (@riptari) October 18, 2018

With attention to detail, good connections (in all senses) and the application of digital forensics all sorts of discrete data dots can be linked — enabling official narratives to be interrogated and unpicked with technology-fuelled speed.

Witness, for example, how quickly the Kremlin’s official line on the Skripal poisonings unravelled.

After the UK released CCTV of two Russian suspects of the Novichok attack in Salisbury, last month, the speedy counter-claim from Russia, presented most obviously via an ‘interview’ with the two ‘citizens’ conducted by state mouthpiece broadcaster RT, was that the men were just tourists with a special interest in the cultural heritage of the small English town.

Nothing to see here, claimed the Russian state, even though the two unlikely tourists didn’t appear to have done much actual sightseeing on their flying visit to the UK during the tail end of a British winter (unless you count vicarious viewing of Salisbury’s wikipedia page).

But digital forensics outfit Bellingcat, partnering with investigative journalists at The Insider Russia, quickly found plenty to dig up online, and with the help of data-providing tips. (We can only speculate who those whistleblowers might be.)

Their investigation made use of a leaked database of Russian passport documents; passport scans provided by sources; publicly available online videos and selfies of the suspects; and even visual computing expertise to academically cross-match photos taken 15 years apart — to, within a few weeks, credibly unmask the ‘tourists’ as two decorated GRU agents: Anatoliy Chepiga and Dr Alexander Yevgeniyevich Mishkin.

When public opinion is faced with an official narrative already lacking credibility that’s soon set against external investigation able to closely show workings and sources (where possible), and thus demonstrate how reasonably constructed and plausible is the counter narrative, there’s little doubt where the real authority is being shown to lie.

And who the real liars are.

That the Kremlin lies is hardly news, of course. But when its lies are so painstakingly and publicly unpicked, and its veneer of untruth ripped away, there is undoubtedly reputational damage to the authority of Vladimir Putin.

The sheer depth and availability of data in the digital era supports faster-than-ever evidence-based debunking of official fictions, threatening to erode rogue regimes built on lies by pulling away the curtain that invests their leaders with power in the first place — by implying the scope and range of their capacity and competency is unknowable, and letting other players on the world stage accept such a ‘leader’ at face value.

The truth about power is often far more stupid and sordid than the fiction. So a powerful abuser, with their workings revealed, can be reduced to their baser parts — and shown for the thuggish and brutal operator they really are, as well as proved a liar.

On the stupidity front, in another recent and impressive bit of cross-referencing, Bellingcat was able to turn passport data pertaining to another four GRU agents — whose identities had been made public by Dutch and UK intelligence agencies (after they had been caught trying to hack into the network of the Organisation for the Prohibition of Chemical Weapons) — into a long list of 305 suggestively linked individuals also affiliated with the same GRU military unit, and whose personal data had been sitting in a publicly available automobile registration database… Oops.

There’s no doubt certain governments have wised up to the power of public data and are actively releasing key info into the public domain where it can be poured over by journalists and interested citizen investigators — be that CCTV imagery of suspects or actual passport scans of known agents.

A cynic might call this selective leaking. But while the choice of what to release may well be self-serving, the veracity of the data itself is far harder to dispute. Exactly because it can be cross-referenced with so many other publicly available sources and so made to speak for itself.

Right now, we’re in the midst of another fast-unfolding example of surveillance apparatus and public data standing in the way of dubious state claims — in the case of the disappearance of Washington Post journalist Jamal Khashoggi, who went into the Saudi consulate in Istanbul on October 2 for a pre-arranged appointment to collect papers for his wedding and never came out.

Saudi authorities first tried to claim Khashoggi left the consulate the same day, though did not provide any evidence to back up their claim. And CCTV clearly showed him going in.

► VIDEO: CCTV footage shows journalist Jamal Khashoggi walking into the Saudi consulate in Istanbul before he disappeared https://t.co/cHGjwmNT4a pic.twitter.com/ML4aItvOuP

— Irish Times Video (@irishtimesvideo) October 10, 2018

Yesterday they finally admitted he was dead — but are now trying to claim he died quarrelling in a fistfight, attempting to spin another after-the-fact narrative to cover up and blame-shift the targeted slaying of a journalist who had written critically about the Saudi regime.

Since Khashoggi went missing, CCTV and publicly available data has also been pulled and compared to identify a group of Saudi men who flew into Istanbul just prior to his appointment at the consulate; were caught on camera outside it; and left Turkey immediately after he had vanished.

Including naming a leading Saudi forensics doctor, Dr Salah Muhammed al-Tubaigy, as being among the party that Turkish government sources also told journalists had been carrying a bone saw in their luggage.

Men in the group have also been linked to Saudi crown prince Mohammed bin Salman, via cross-referencing travel records and social media data.

“In a 2017 video published by the Saudi-owned Al Ekhbariya on YouTube, a man wearing a uniform name tag bearing the same name can be seen standing next to the crown prince. A user with the same name on the Saudi app Menom3ay is listed as a member of the royal guard,” writes the Guardian, joining the dots on another suspected henchman.

A marked element of the Khashoggi case has been the explicit descriptions of his fate leaked to journalists by Turkish government sources, who have said they have recordings of his interrogation, torture and killing inside the building — presumably via bugs either installed in the consulate itself or via intercepts placed on devices held by the individuals inside.

This surveillance material has reportedly been shared with US officials, where it must be shaping the geopolitical response — making it harder for President Trump to do what he really wants to do, and stick like glue to a regional US ally with which he has his own personal financial ties, because the arms of that state have been recorded in the literal act of cutting off the fingers and head of a critical journalist, and then sawing up and disposing of the rest of his body.

Attempts by the Saudis to construct a plausible narrative to explain what happened to Khashoggi when he stepped over its consulate threshold to pick up papers for his forthcoming wedding have failed in the face of all the contrary data.

Meanwhile, the search for a body goes on.

And attempts by the Saudis to shift blame for the heinous act away from the crown prince himself are also being discredited by the weight of data…

Here is Saud al-Qahtani – advisor to MBS who has been sacked and blamed for the murder of Jamal #Khashoggi – saying a year ago he only acts on the orders of King Salman and the Crown Prince MBS “Do you think I’m acting on my own without guidance?”(correction on date) https://t.co/mN2NEkbihX

— Bel Trew (@Beltrew) October 20, 2018

And while it remains to be seen what sanctions, if any, the Saudis will face from Trump’s conflicted administration, the crown prince is already being hit where it hurts by the global business community withdrawing in horror from the prospect of being tainted by bloody association.

The idea that a company as reputation-sensitive as Apple would be just fine investing billions more alongside the Saudi regime, in SoftBank’s massive Vision Fund vehicle, seems unlikely, to say the least.

Thanks to technology’s surveillance creep the world has been given a close-up view of how horrifyingly brutal the Saudi regime can be — and through the lens of an individual it can empathize with and understand.

Safe to say, supporting second acts for regimes that cut off fingers and sever heads isn’t something any CEO would want to become famous for.

The power of technology to erode privacy is clearer than ever. Down to the very teeth of the bone saw. But what’s also increasingly clear is that powerful and at times terrible capability can be turned around to debase power itself — when authorities themselves become abusers.

So the flip-side of the surveillance state can be seen in the public airing of the bloody colors of abusive regimes.

Turns out, microscopic details can make all the difference to geopolitics.

RIP Jamal Khashoggi