A Military Strike On A Korean Airliner Prompted Public Access To What? |

|

Think you know the answer? |

|

from How-To Geek https://ift.tt/2T8EX1Z

A Military Strike On A Korean Airliner Prompted Public Access To What? |

|

Think you know the answer? |

|

![]() Farhad Manjoo / New York Times:

Farhad Manjoo / New York Times:

Netflix uses subtitles and dubs in many languages to widen audiences for its shows because its subscription model incentivizes it to appeal to global customers — Instead of trying to sell American ideas to a foreign audience, it's aiming to sell international ideas to a global audience.

![]() Daniel Palmer / CoinDesk:

Daniel Palmer / CoinDesk:

CipherTrace, which provides blockchain analytics and forensics services that regulators and governments use to stop money laundering, raises $15M — Blockchain and cryptocurrency security firm CipherTrace has raised $15 million in funding from investors including Mike Novogratz's Galaxy Digital, the firm announced Tuesday.

![]() Rita Liao / TechCrunch:

Rita Liao / TechCrunch:

Eyeing international expansion, China-based selfie app maker Meitu acquires a 31% stake in game publishing company Dreamscape Horizon for ~$340M — China's largest selfie app maker Meitu has been busy working to diversify itself beyond the beauty arena in China.

![]() Dean Takahashi / VentureBeat:

Dean Takahashi / VentureBeat:

Report: 30.4% of e-sports viewers in Q4 2018 were women, up from 23.9% in 2016 — Women's viewership of esports grew from 23.9 percent of all watchers in 2016 to 30.4 percent in the fourth quarter of 2018, according to a report by market researcher Interpret.

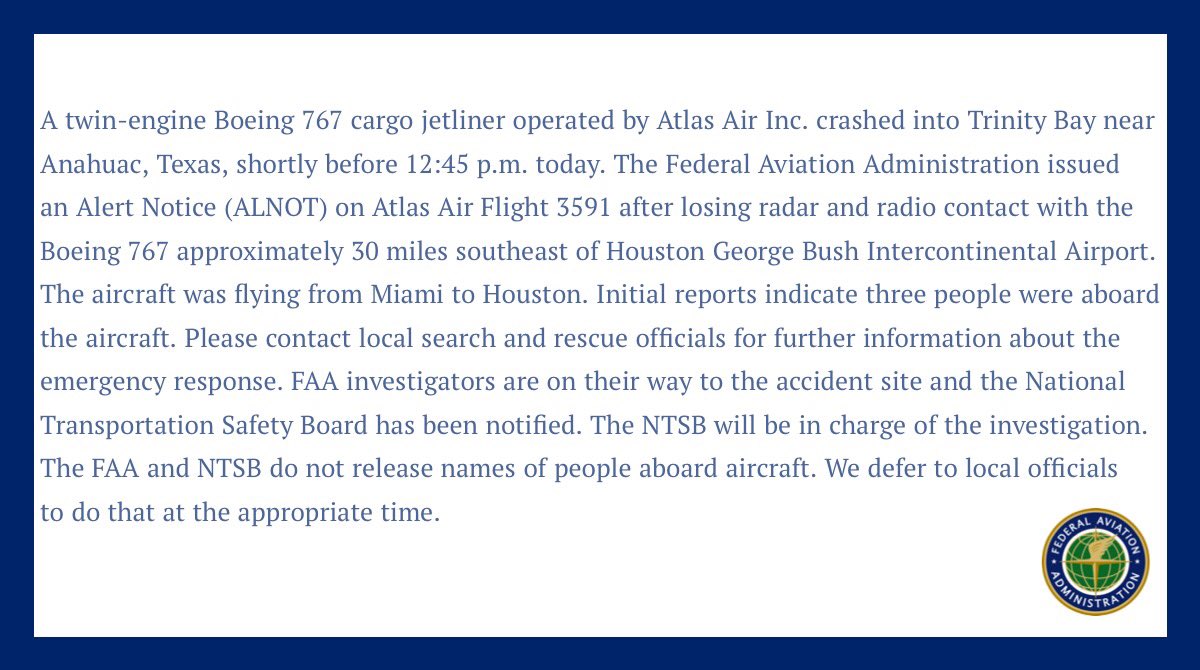

An Atlas cargo plane flying on behalf of Amazon Air — Amazon’s own freight delivery service that competes with FedEx and UPS, among others — has crashed outside Houston, Texas, killing three passengers on board.

Amazon and Atlas both confirmed the accident with short statements. Neither provided any details on the nature of the accident.

“Our thoughts and prayers are with the flight crew, their families and friends along with the entire team at Atlas Air during this terrible tragedy. We appreciate the first responders who worked urgently to provide support,” said Dave Clark, SVP of worldwide operations at Amazon.

“This is to confirm that an Atlas Air 767 cargo aircraft Flight No. 3591 operating from Miami to Houston has been involved in an accident this afternoon,” reads a statement from Atlas. “We understand the aircraft went down near the city of Anahuac Texas, in the Trinity Bay. We can confirm there were three people on board the aircraft. Those people and their family members are our top priority at this time. Atlas Air is cooperating fully with the FAA and NTSB. We will update as additional information becomes available.”

The Boeing 767 cargo jetliner lost contact on radio and radar around 12:45pm local time after crashing into Trinity Bay close to Anahuac, a small city about 30 miles from Houston. Local news reported officials on the ground saying there is unlikely to be survivors.

The aircraft, Atlas Air Flight 3591, was flying from Miami on behalf of Amazon, according to flight tracking site Flightradar24.

Many people are reporting the crash as a “Prime Air” incident, but this isn’t completely accurate. Originally, Amazon Air was branded “Prime Air”, and this appears to be the logo that still runs on many of these planes — but Amazon rebranded the service in December 2017. Amazon Prime Air now refers to the company’s efforts to build a drone delivery network.

As we have noted, it is not yet clear what caused the crash. The Federal Aviation Administration confirmed the accident in a statement, deferring the investigation to the National Transportation Safety Board, which said in a tweet that it has dispatched investigators to the crash site.

We have also contacted Amazon and Atlas for comment, and we will update this post with their responses.

Counting today’s plane, Amazon has 40 aircraft operating under the Amazon Air brand, serving some 23 airports in the U.S.

Counting today’s plane, Amazon has 40 aircraft operating under the Amazon Air brand, serving some 23 airports in the U.S.

One looming question is how and if today’s incident will impact Amazon’s bigger strategy with freight delivery.

The company has been building its own network of cargo planes since 2015, a strategy that serves a couple of purposes. It gives Amazon more control (both in terms of scheduling and costs) over air-based logistics for the transport of goods that it sells; and it gives Amazon a shot at taking on some of the air shipping business that FedEx and UPS provide for other companies.

Amazon Air has quietly but steadily grown over the years. Amazon currently has plans to add another 10 aircraft during 2019 and 2020, leasing them from Air Transport Services Group, an Atlas competitor. Notably, Amazon has stakes in both Atlas and ATSG as part of this bigger bet on taking on other larger cargo carriers with its own freight delivery service.

More soon.

![]() Vivienne Walt / Fortune:

Vivienne Walt / Fortune:

An overview of Google's efforts to scale its business in India, where falling data prices and rising smartphone penetration have opened up big new opportunities — Patchy Internet, multiple languages, low smartphone penetration: But a big opportunity. — It is already dark in the New Delhi suburb …

More than 100 Microsoft employees have signed a letter sent to CEO Satya Nadella and President Brad Smith criticizing the company’s plans to build HoloLens AR tech for the military, the organizing group said Friday. The development is part of a $480 million military contract that Microsoft won this past November.

The group’s letter demands that the company cancel their work on the contract and cease development of weapons technologies. “We did not sign up to develop weapons, and we demand a say in how our work is used,” the letter further states.

Microsoft has been focusing its augmented reality efforts on enterprise customers but had aggressively pursued the military contract, beating out other applicants including billions-backed startup Magic Leap. The contract is essentially a pilot program to begin outfitting the U.S. military with augmented reality visors and software tools to help with training and combat.

The letter protesting the nearly half-billion-dollar deal came just a couple days before Microsoft was expected to release a second-generation HoloLens at an event in Barcelona.

On behalf of workers at Microsoft, we're releasing an open letter to Brad Smith and Satya Nadella, demanding for the cancelation of the IVAS contract with a call for stricter ethical guidelines.

If you're a Microsoft employee you can sign at: https://t.co/958AhvIHO5 pic.twitter.com/uUZ5P4FJ7X— Microsoft Workers 4 Good (@MsWorkers4) February 22, 2019

In October, Microsoft President Brad Smith published a blog expressing the company’s support for the military projects it was pursuing, saying “we believe in the strong defense of the United States and we want the people who defend it to have access to the nation’s best technology, including from Microsoft.” That letter was into the company’s substantially more impactful bid to win the $10 billion JEDI cloud infrastructure contract, but the sign of more pushback from a small group of employees showcases that not everyone at the company believes that Microsoft should be assisting the U.S. military.

![]() Joseph Bernstein / BuzzFeed News:

Joseph Bernstein / BuzzFeed News:

Survey of 1,000 tech industry workers: 51% believe “Trump has a point when it comes to the media producing fake news” and 59% favor working with the US military — A new study by BuzzFeed News and Lucid surveyed tech workers on their attitudes toward the media.

The internet’s address book keeper has warned of an “ongoing and significant risk” to key parts of the domain name system infrastructure, following months of increased attacks.

The Internet Corporation for Assigned Names and Numbers, or ICANN, issued the notice late Friday, saying DNS, which converts numerical internet addresses to domain names, has been the victim of “multifaceted attacks utilizing different methodologies.”

It follows similar warnings from security companies and the federal government in the wake of attacks believe to be orchestrated by nation state hackers.

In January, security company FireEye revealed that hackers likely associated with Iran were hijacking DNS records on a massive scale, by rerouting users from a legitimate web address to a malicious server to steal passwords. This so-called “DNSpionage” campaign, dubbed by Cisco’s Talos intelligence team, was targeting governments in Lebanon and the United Arab Emirates. Homeland Security’s newly founded Cybersecurity Infrastructure Security Agency later warned that U.S. agencies were also under attack. In its first emergency order amid a government shutdown, the agency ordered federal agencies to take action against DNS tampering.

ICANN’s chief technology officer David Conrad told the AFP news agency that the hackers are “going after the Internet infrastructure itself.”

The internet organization’s solution is calling on domain owners to deploy DNSSEC, a more secure version of DNS that’s more difficult to manipulate. DNSSEC cryptographically signs data to make it more difficult — though not impossible — to spoof.

But adoption has been glacial. Only three percent of the Fortune 1,000 are using DNSSEC, according to statistics by Cloudflare released in September. Internet companies like Cloudflare and Google have pushed for greater adoption by rolling out one-click enabling of DNSSEC to domain name owners.

DNSSEC adoption is currently at about 20 percent.

![]() Recode:

Recode:

AT&T CEO on 5G deployment, how 5G may replace broadband in 3 to 5 years, new applications it will enable, and leveraging Time Warner for its streaming services — Stephenson talks about sports gambling, the potential of 5G, and buying Time Warner. — On the latest episode of Recode Media …

Through the Extra Crunch EC-1 on Patreon, I dove into Patreon’s founding story, product roadmap, business model and metrics, underlying thesis, and competitive threats. The six-year-old company last valued around $450 million and likely to soon hit $1 billion is the leading platform for artists to run membership businesses for their superfans.

As a conclusion to my report, I have three core takeaways and some predictions on the possibility of an IPO or acquisition in the company’s future.

First, the future is promising for independent content creators who are building engaged, passionate fanbases.

There is a surge of interest from the biggest social media platforms in creating more features to help them directly monetize their fans — with each trying to one-up the others. There are also a growing number of independent solutions for creators to use as well (Patreon and Memberful, Substack, Pico, etc.).

We live in an economy where a soaring number of people are self-employed, and the rise of more monetization tools for creators to earn a stable income will open the door to more people turning their creative talents into a part-time or full-time business pursuit.

Patreon’s play is to own a niche category of SMB who it recognizes has particular needs and provide them with the comprehensive suite of tools and services they need to manage their businesses. A large portion of creators’ incomes will need to go to Patreon for it to someday earn billions of dollars in annual revenue.

The market for content creators to build membership businesses appears to be growing, however, membership will be only one piece of the fan-to-creator monetization wave. The number of creators who are a fit for the membership business model and could generate $1,000-500,000 per month through Patreon (its target customer profile) is likely measured in the tens of thousands or low hundreds of thousands right now, rather than in the millions.

To get a sense of the revenue math here, Patreon will generate about $35 million this year from the 5,000-6,000 creators who fit its target customer profile; if you believe this market is expanding at a fast clip, capturing 10% of the revenue (Patreon’s current commission) from 20,000 such creators could bring in $140 million. And that’s without factoring in the potential success of Patreon implementing premium pricing options, which is a high priority. If Patreon can increase its commission from 10% to 15%, it would need around 47,500 creators in the $1,000-$500,000/month range (9.5x its current number) to reach $500 million in revenue from them.

There is a compelling opportunity for a company to provide the dominant business hub for creators, with tools to manage their fan (i.e. customer) relationships across platforms and to manage back-office logistics. At a certain point it taps out though.

That’s one of the reasons why Patreon’s vision includes extending into areas like business loans and healthcare. For companies targeting small and medium businesses like Shopify, Salesforce and Dropbox, there is so much more growth tied to their core products that there is no need for them to consider such unrelated offerings as business loans. Patreon has to both expand its market share and also expand the services it offers to those customers if it wants to reach massive scale.

Patreon is the leading contender in this market, and there’s a role for an independent player even if Facebook, YouTube, and other distribution platforms push directly competing functionality. Patreon will need to make three important changes to compete effectively: more aggressively segment its customers, make the consumer-facing side of its platform more customizable by creators, and build out more lightweight talent management services.

Having raised over $100 million in funding over the last six years, what is the path to a liquidity event for investors and employees?

In a worst case scenario, it is unlikely the company would go out of business even if it fell into disarray because it would be strategic for several large companies to takeover at a discount. Patreon may be on the path to IPO (as CEO Jack Conte hopes), but I find it more likely that the company gets acquired sometime in the next couple years.

If a public offering is in Patreon’s future, it’s several years out. It now defines itself as a SaaS company and has a plan to earn a higher blended commission on the sales of its customers through premium pricing options. It is a frequently misunderstood company, however, and needs to prove that a big market exists for mid-tail creators building membership businesses.

According to a summary by Spark Capital’s Alex Clayton, SaaS companies who went public in 2018 typically:

Public market companies to benchmark it against will be Shopify (as SaaS infrastructure for small businesses selling to, and managing payments from, consumers) and Zuora (Patreon can be viewed as a media-specific SMB alternative to Zuora’s “Subscription Relationship Management” system). Compared to Shopify, whose market of SMB e-commerce businesses globally is easily understood to be enormous, Patreon would face more skepticism from public investors about the market size of mid-tail content creators.

Patreon’s gross margins can’t be much more than 50% given that almost half of revenue is going toward payment processing. Patreon mirrors Shopify’s topline revenue growth in the run up to its 2015 IPO: Shopify reported $23.7 million for 2012, $50.3 million for 2013, $105 million for 2014 and I estimate Patreon brought in $15 million for 2017, $30 million for 2018, and will hit $55 million for 2019. Most of Shopify’s revenue came from subscriptions, however, with only 37% coming from the “merchant solutions” services where Shopify had to pay out payment processing fees. Patreon’s revenue net of payment processing fees is closer to $7.5 million for 2017, $15 million for 2018, and $27 million (predicted) for 2019.

There’s a lot of capital chasing late-stage startups right now. How long that remains the case is unknown, but Patreon can likely raise the funding to operate unprofitably a few more years — getting topline revenue closer to $150-200 million, proving creators will adopt premium pricing, and showcasing its ability to compete with Facebook and YouTube in a growing market. In that case, it could become a strong IPO candidate.

The other scenario, of course, is that a larger company buys Patreon. In particular, one of the large social media platforms building directly competitive features may decide it is easier to buy their expansion into membership than build it from scratch. Patreon is the dominant platform without any noteworthy direct competitor among independent companies, so acquiring it would immediately put the parent company in a market-leading position. Competing social platforms wouldn’t have another large Patreon-like startup to acquire in response.

There are three companies that jump out as both the most likely acquirers. Each of these M&A scenarios would be mutually beneficial: advancing Patreon’s mission and providing strategic value to the parent. The first two companies are probably obvious, but the last one may be less known to TechCrunch readers.

I highlighted Facebook as the top competitive threat to Patreon. This is also why it’s a natural acquirer. Patreon would bring fan relationship management to the Facebook ecosystem and particularly the company’s Creator App with CRM and analytics specifically fit for creators’ needs. It would also bring a stable of 130,000 creators of all types to make Facebook the primary infrastructure through which they engage their core fans.

Facebook is prioritizing human relationships more and clickbait content less. A natural replacement for the flood of news articles and viral videos is deeper engagement with the creators that Facebook users care the most about.

Since the annual churn rate of Patreon creators who earn $500 per month or more is under 1%, the ~9,200 creators who fit that category would likely stick around as Patreon’s infrastructure integrates with Facebook’s; the vast majority probably already have Facebook pages and possibly use the Creator App.

Facebook’s data on who fans are, what they like, and who their friends are is unrivalled. The insights Facebook could provide Patreon’s creators on their fans could help them substantially grow their number of patrons and build stronger relationships with them.

Like all major social media platforms, Facebook has partnership teams vying to get major celebrities to use its products. Patreon could lock the mid-tail of smaller (but still established) creators into its ecosystem, which means more consumer engagement, more time well spent, and more revenue through both ads and fan-to-creator transactions. Owning and integrating Patreon could have a much bigger financial benefit than solely revenue from the core Patreon product.

As a Facebook subsidiary, Patreon would stick more closely to being a software solution; it wouldn’t develop as robust of a creator support staff and the vision that it may expand to offer business loans and health insurance to creators would almost surely be cut. Facebook would also probably discontinue supporting the roughly 23% of Patreon creators who make not-safe-for-work (NSFW) content.

Given Patreon’s mission to help creators get paid, it may make a bigger impact as part of Facebook nonetheless. Facebook’s ecosystem of apps is where creators and their fans already are. Tens of thousands of creators could start using Patreon’s CRM infrastructure overnight and activating fan memberships to earn stable income.

A Facebook-Patreon deal could happen at any point. I think a deal could just as likely happen in a few months as in a few years. The key will be Facebook’s business strategy: does it want to build serious infrastructure for creators? And does it believe paywalled access to some content and groups fits the future of Facebook? The company is experimenting with both of those right now, but doesn’t appear to be committed as of yet.

The other most likely acquirer is Google-owned YouTube. Patreon was birthed by a YouTuber to support himself and fellow creators after their AdSense income dropped substantially. YouTube is becoming a direct competitor through YouTube Memberships and merchandise integrations.

If Patreon shows initial success in getting creators to adopt premium pricing tiers and YouTube sees a strong response to the membership functionality it has rolled out, it’s hard to imagine YouTube not making a play to acquire Patreon and make membership a priority in product development. This would create a whole new market for it to dominate, making money by selling business features to creators and encouraging fan-to-creator payments to happen through its platform.

In the meantime, it seems that YouTube is still searching for an answer to whether membership fits within its scope. It previously removed the ability for creators to paywall some videos and it could view fan-to-creator monetization efforts as a distraction from its dominance as an advertising platform and its growing strength in streaming TV online (through the popular $40/month YouTube TV subscription).

YouTube is also a less compelling acquirer than Facebook because the majority of Patreon’s creators don’t have a place on YouTube since they don’t produce video content (as least as their primary content type). Unless YouTube expands its platform to support podcasts and still images as well, it would be paying a premium to acquire the subset of Patreon creators that it wants. Moreover, as much as a quarter of those may be creators of NSFW content that YouTube prohibits.

YouTube is the potential Patreon acquirer people immediately point to, but it’s not as tight of a fit as Facebook would be…or as Endeavor would be.

The third scenario is that a major company in the entertainment and talent representation sphere sees acquiring Patreon as a strategic play to expand into a whole new category of talent representation with a technology-first approach. There is only one contender here: Endeavor, the $6.3 billion holding company led by Ari Emanuel and Patrick Whitesell that is backed by Silver Lake, Softbank, Fidelity, and Singapore’s GIC and has been on an acquisition spree.

This pairing shows promise. Facebook and YouTube are the most likely companies to acquire Patreon, but Endeavor may be the company best fit to acquire it.

Endeavor is an ecosystem of companies — with the world’s top talent agency WME-IMG at the center — that can each integrate with each other in different ways to collectively become a driving force in global entertainment, sports and fashion. Among the 25+ companies it has bought are sports leagues like the UFC (for $4 billion) and the video streaming infrastructure startup NeuLion (for $250 million). In September, it launched a division, Endeavor Audio, to develop, finance and market podcasts.

Endeavor wants to leverage its talent and evolve its revenue model toward scalable businesses. In 2015, Emanuel said revenue was 60% from representation and 40% from “the ownership of assets” but quickly shifting; last year Variety noted the revenue split as 50/50.

In alignment with Patreon, Endeavor is a big company centered on guiding the business activities of all types of artists and helping them build out (and maximize) new revenue streams. When you hear Emanuel and Whitesell, they reiterate the same talking points that Patreon CEO Jack Conte does: artists are now multifaceted, and not stuck to one activity. They are building their own businesses and don’t want to be beholden to distribution platforms. Patreon could thrive under Endeavor given their alignment of values and mission. Endeavor would want Patreon to grow in line with Conte’s vision, without fearing that it would cannibalize ad revenue (a concern Facebook and YouTube would both have).

In a June interview, Whitesell noted that Endeavor’s M&A is targeted at companies that either expand their existing businesses or ones where they can uniquely leverage their existing businesses to grow much faster than they otherwise could. Patreon fits both conditions.

Patreon would be the scalable asset that plugs the mid-tail of creators into the Endeavor ecosystem. Whereas WME-IMG is high-touch relationship management with a little bit of tech, Patreon is a tech company with a layer of talent relationship management. Patreon can serve tens of thousands of money-making creators at scale. Endeavor can bring its talent expertise to help Patreon provide better service to creators; Patreon would bring technology expertise to help Endeavor’s traditional talent representation businesses better analyze clients’ fanbases and build direct fan-to-creator revenue streams for clients.

If there’s opportunity to eventually expand the membership business model among the top tiers of creators using Patreon.com or Memberful (which Conte hinted at in our interviews), Endeavor could facilitate the initial experiments with major VIPs. If memberships are shown to make more money for top artists, that means more money in the pockets of their agents at WME-IMG and for Endeavor overall, so incentives are aligned.

Endeavor would also rid Patreon of the “starving artist” brand that still accompanies it and could open a lot of doors in for Patreon creators whose careers are gaining momentum. Perhaps other Endeavor companies could access Patreon data to identify specific creators fit for other opportunities.

An Endeavor-Patreon deal would need to occur before Patreon’s valuation gets too high. Endeavor doesn’t have tens of billions in cash sitting on its balance sheet like Google and Facebook do. Endeavor can’t use much debt to buy Patreon either: its leverage ratio is already high, resulting in Moody’s putting its credit rating under review for downgrade in December. Endeavor has repeatedly raised more equity funding though and is likely to do so again; it canceled a $400M investment from the Saudi government at the last minute in October due to political concerns but is likely pitching other investors to take its place.

Patreon has strong revenue growth and the opportunity to retain dominant market share in providing business infrastructure for creators — a market that seems to be growing. Whether it stays independent and can thrive in the public markets sometime or whether it will find more success under the umbrella of a strategic acquirer remains to be seen. Right now the latter path is the more compelling one.

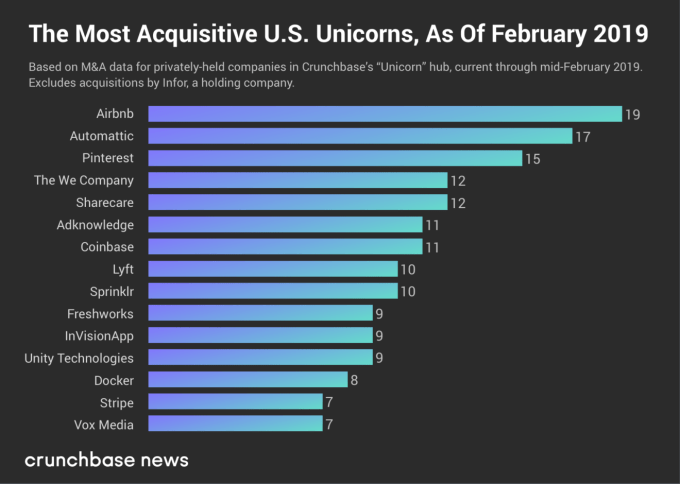

It takes a lot more than a good idea and the right timing to build a billion-dollar company. Talent, focus, operational effectiveness and a healthy dose of luck are all components of a successful tech startup. Many of the most successful (or, at least, highest-valued) tech unicorns today didn’t get there alone.

Mergers and acquisitions (M&A) can be a major growth vector for rapidly scaling, highly valued technology companies. It’s a topic that we’ve covered off and on since the very first post on Crunchbase News in March 2017. Nearly two years later, we wanted to revisit that first post because things move quickly, and there is a new crop of companies in the unicorn spotlight these days. Which ones are the most active in the M&A market these days?

Before displaying the U.S. unicorns with the most acquisitions to date, we first have to answer the question, “What is a unicorn?” The term is generally applied to venture-backed technology companies that have earned a valuation of $1 billion or more. Crunchbase tracks these companies in its Unicorns hub. The original definition of the term, first applied in a VC setting by Aileen Lee of Cowboy Ventures back in late 2011, specifies that unicorns were founded in or after 2003, following the first tech bubble. That’s the working definition we’ll be using here.

In the chart below, we display the number of known acquisitions made by U.S.-based unicorns that haven’t gone public or gotten acquired (yet). Keep in mind this is based on a snapshot of Crunchbase data, so the numbers and ranking may have changed by the time you read this. To maintain legibility and a reasonable size, we cut off the chart at companies that made seven or more acquisitions.

As one would expect, these rankings are somewhat different from the one we did two years ago. Several companies counted back in early March 2017 have since graduated to public markets or have been acquired.

Dropbox, which had acquired 23 companies at the time of our last analysis, went public weeks later and has since acquired two more companies (HelloSign for $230 million in late January 2019 and Verst for an undisclosed sum in November 2017) since doing so. SurveyMonkey, which went public in September 2018, made six known acquisitions before making its exit via IPO.

Which companies are still in the top ranks? Travel accommodations marketplace giant Airbnb jumped from number four to claim Dropbox’s vacancy as the most acquisitive private U.S. unicorn in the market. Airbnb made six more acquisitions since March 2017, most recently Danish event space and meeting venue marketplace Gaest.com. The still-pending deal was announced in January 2019.

WordPress developer and hosting company Automattic is still ranked number two. Automattic href="https://www.crunchbase.com/acquisition/automattic-acquires-atavist--912abccd">acquired one more company — digital publication platform Atavist — since we last profiled unicorn M&A. Open-source software containerization company Docker, photo-sharing and search site Pinterest, enterprise social media management company Sprinklr and venture-backed media company Vox Media remain, as well.

There are some notable newcomers in these rankings. We’ll focus on the most notable three: The We Company, Coinbase and Lyft. (Honorable mention goes to Stripe and Unity Technologies, which are also new to this list.)

The We Company (the holding entity for WeWork) has made 10 acquisitions over the past two years. Earlier this month, The We Company bought Euclid, a company that analyzes physical space utilization and tracks visitors using Wi-Fi fingerprinting. Other buyouts include Meetup (a story broken by Crunchbase News in November 2017) reportedly for $200 million. Also in late 2017, The We Company acquired coding and design training program Flatiron School, giving the company a permanent tenant in some of its commercial spaces.

In its bid to solidify its position as the dominant consumer cryptocurrency player, Coinbase has been on quite the M&A tear lately. The company recently announced its plans to acquire Neutrino, a blockchain analytics and intelligence platform company based in Italy. As we covered, Coinbase likely made the deal to improve its compliance efforts. In January, Coinbase acquired data analysis company Blockspring, also for an undisclosed sum. The crypto company’s other most notable deal to date was its April 2018 buyout of the bitcoin mining hardware turned cryptocurrency micro-transaction platform Earn.com, which Coinbase acquired for $120 million.

And finally, there’s Lyft, the more exclusively U.S.-focused ride-hailing and transportation service company. Lyft has made 10 known acquisitions since it was founded in 2012. Its latest M&A deal was urban bike service Motivate, which Lyft acquired in June 2018. Lyft’s principal rival, Uber, has acquired six companies at the time of writing. Uber bought a bike company of its own, JUMP Bikes, at a price of $200 million, a couple of months prior to Lyft’s Motivate purchase. Here too, the Lyft-Uber rivalry manifests in structural sameness. Fierce competition drove Uber and Lyft to raise money in lock-step with one another, and drove M&A strategy as well.

With long-term business success, it’s often a chicken-and-egg question. Is a company successful because of the startups it bought along the way? Or did it buy companies because it was successful and had an opening to expand? Oftentimes, it’s a little of both.

The unicorn companies that dominate the private funding landscape today (if not in the number of deals, then in dollar volume for sure) continue to raise money in the name of growth. Growth can come the old-fashioned way, by establishing a market position and expanding it. Or, in the name of rapid scaling and ostensibly maximizing investor returns, M&A provides a lateral route into new markets or a way to further entrench the status quo. We’ll see how that strategy pays off when these companies eventually find the exit door .