Whose Death Brought Twitter, Wikipedia, And Other Sites To Their Knees? |

|

Think you know the answer? |

|

from How-To Geek http://bit.ly/2QJafXH

Whose Death Brought Twitter, Wikipedia, And Other Sites To Their Knees? |

|

Think you know the answer? |

|

![]() Emilie Filou / Quartz:

Emilie Filou / Quartz:

Madagascar's data processing and call centers for international clients flourished after it built out cable internet in 2009 with speeds exceeding those of UK — In a large, open-space office, employees are busy processing promotional coupons for a well-known supermarket chain …

![]() Sarah Perez / TechCrunch:

Sarah Perez / TechCrunch:

Plex is in talks to offer ad-supported movies and more premium subscriptions as soon as this year, taking on Roku Channel and Amazon Prime Video Channels — Media software maker Plex is preparing to take on The Roku Channel and Amazon Prime Video Channels, possibly as soon as this year.

![]() Sarah Sluis / AdExchanger:

Sarah Sluis / AdExchanger:

Piano, a SaaS platform for digital publishers including 1,300 media brands, raises $22M Series B to help publishers bring in non-ad revenue — Piano, whose tech and services gives digital publishers a way to supplement their ad revenue, raised $22 million in Series B funding Thursday to expand …

![]() Natasha Lomas / TechCrunch:

Natasha Lomas / TechCrunch:

Spanish on-demand laundry and dry cleaning startup Mr Jeff raises $12M Series A led by All Iron Ventures with plans to expand to 30 countries by end of 2019 — If you thought the on-demand laundry space had run out of startup steam, here's a bit of a conditioner: Spanish startup Mr Jeff …

![]() Dan Goodin / Ars Technica:

Dan Goodin / Ars Technica:

Researchers: a hacking group made ~$3.7M in Bitcoin since Aug. with Ryuk ransomware, which only targets firms with huge resources and can lay dormant for a year — Ryuk lies in wait for as long as a year, then pounces on only the biggest prey. — A recently discovered ransomware group …

In late October following a significant victory for Jair Bolsonaro in Brazil’s presidential elections, the stock market for Latin America’s largest country shot up. Financial markets reacted favorably to the news because Bolsonaro, a free-market proponent, promises to deliver broad economic reforms, fight corruption and work to reshape Brazil through a pro-business agenda. While some have dubbed him as a far-right “Trump of the Tropics” against a backdrop of many Brazilians feeling that government has failed them, the business outlook is extremely positive.

When President-elect Bolsonaro appointed Santander executive Roberto Campos as new head of Brazil’s central bank in mid-November, Brazil’s stock market cheered again with Sao Paulo’s Bovespa stocks surging as much as 2.65 percent on the day news was announced. According to Reuters, “analysts said Bolsonaro, a former army captain and lawmaker who has admitted to having scant knowledge of economics, was assembling an experienced economic team to implement his plans to slash government spending, simplify Brazil’s complex tax system and sell off state-run companies.”

Admittedly, there are some challenges as well. Most notably, pension-system reform tops the list of priorities to get on the right track quickly. A costly pension system is increasing the country’s debt and contributed to Brazil losing its investment-grade credit rating in 2015. According to the new administration, Brazil’s domestic product could grow by 3.5 percent during 2019 if Congress approves pension reform soon. The other issue that’s cropped up to tarnish the glow of Bolsonaro coming into power are suspect payments made to his son that are being examined by COAF, the financial crimes unit.

While the jury is still out on Bolsonaro’s impact on Brazilian society at large after being portrayed as the Brazilian Trump by the opposition party, he’s come across as less authoritarian during his first days in office. Since the election, his tone is calmer and he’s repeatedly said that he plans to govern for all Brazilians, not just those who voted for him. In his first speech as president, he invited his wife to speak first which has never happened before.

Still, according to The New York Times, “some Brazilians remain deeply divided on the new president, a former army captain who has hailed the country’s military dictators and made disparaging remarks about women and minority groups.”

Others have expressed concern about his environment impact with the “an assault on environmental and Amazon protections” through an executive order within hours of taking office earlier this week. However, some major press outlets have been more upbeat: “With his mix of market-friendly economic policies and social conservativism at home, Mr. Bolsonaro plans to align Brazil more closely with developed nations and particularly the U.S.,” according to the Wall Street Journal this week.

Based on his publicly stated plans, here’s why President Bolsonaro will be good for business and how his administration will help build an even stronger entrepreneurial ecosystem in Brazil:

Bolsonaro’s Ministerial Reform

President Temer leaves office with 29 government ministries. President Bolsonaro plans to reduce the number of ministries to 22, which will reduce spending and make the government smaller and run more efficiently. We expect to see more modern technology implemented to eliminate bureaucratic red tape and government inefficiencies.

Importantly, this will open up more partnerships and contracting of tech startups’ solutions. Government contacts for new technology will be used across nearly all the ministries including mobility, transportation, health, finance, management and legal administration – which will have a positive financial impact especially for the rich and booming SaaS market players in Brazil.

Government Company Privatization

Of Brazil’s 418 government-controlled companies, there are 138 of them on the federal level that could be privatized. In comparison to Brazil’s 418, Chile has 25 government-controlled companies, the U.S. has 12, Australia and Japan each have eight, and Switzerland has four. Together, Brazil-owned companies employ more than 800,000 people today, including about 500,000 federal employees. Some of the largest ones include petroleum company Petrobras, electric utilities company Eletrobras, Banco do Brasil, Latin America’s largest bank in terms of its assets, and Caixa Economica Federal, the largest 100 percent government-owned financial institution in Latin America.

The process of privatizing companies is known to be cumbersome and inefficient, and the transformation from political appointments to professional management will surge the need for better management tools, especially for enterprise SaaS solutions.

STEAM Education to Boost Brazil’s Tech Talent

Based on Bolsonaro’s original plan to move the oversight of university and post-graduate education from the Education Ministry to the Science and Technology Ministry, it’s clear the new presidential administration is favoring more STEAM courses that are focused on Science, Technology, Engineering, the Arts and Mathematics.

Previous administrations threw further support behind humanities-focused education programs. Similar STEAM-focused higher education systems from countries such as Singapore and South Korea have helped to generate a bigger pipeline of qualified engineers and technical talent badly needed by Brazilian startups and larger companies doing business in the country. The additional tech talent boost in the country will help Brazil better compete on the global stage.

The Chicago Boys’ “Super” Ministry

The merger of the Ministry of Economy with the Treasury, Planning and Industry and Foreign Trade and Services ministries will create a super ministry to be run by Dr. Paulo Guedes and his team of Chicago Boys. Trained at the Department of Economics in the University of Chicago under Milton Friedman and Arnold Harberger, the Chicago Boys are a group of prominent Chilean economists who are credited with transforming Chile into Latin America’s best performing economies and one of the world’s most business-friendly jurisdictions. Joaquim Levi, the recently appointed chief of BNDES (Brazilian Development Bank), is also a Chicago Boy and a strong believer in venture capital and startups.

Previously, Guedes was a general partner in Bozano Investimentos, a pioneering private equity firm, before accepting the invitation to take the helm of the world’s eighth-largest economy in Brazil. To have a team of economists who deeply understand the importance of rapid-growth companies is good news for Brazil’s entrepreneurial ecosystem. This group of 30,000 startup companies are responsible for 50 percent of the job openings in Brazil and they’re growing far faster than the country’s GDP.

Bolsonaro’s Pro-Business Cabinet Appointments

President Bolsonaro has appointed a majority of technical experts to be part of his new cabinet. Eight of them have strong technology backgrounds, and this deeper knowledge of the tech sector will better inform decisions and open the way to more funding for innovation.

One of those appointments, Sergio Moro, is the federal judge for the anti-corruption initiative knows as “Operation Car Wash.” With Moro’s nomination to Chief of the Justice Department and his anticipated fight against corruption could generate economic growth and help reduce unemployment in the country. Bolsonaro’s cabinet is also expected to simplify the crazy and overwhelming tax system. More than 40 different taxes could be whittled down to a dozen, making it easier for entrepreneurs to launch new companies.

In general terms, Brazil and Latin America have long suffered from deep inefficiencies. With Bolsonaro’s administration, there’s new promise that there will be an increase in long-term infrastructure investments, reforms to reduce corruption and bureaucratic red tape, and enthusiasm and support for startup investments in entrepreneurs who will lead the country’s fastest-growing companies and make significant technology advancements to “lift all boats.”

![]() Taylor Hatmaker / TechCrunch:

Taylor Hatmaker / TechCrunch:

Research shows self-reported heavy Facebook users make impaired decisions, like drug addicts, on a classic test of maximizing rewards — Researchers at Michigan State University are exploring the idea that there's more to “social media addiction” than casual joking about being too online might suggest.

![]() Rita Katz / Wired:

Rita Katz / Wired:

How ISIS is changing how it uses tech to recruit and coordinate, by moving to free public chat apps and services like RocketChat, Yahoo Together, Viber, Discord — HEADS UP, TECH companies: If your product appeals to the masses, it likely also holds allure for terrorist groups like ISIS.

![]() Sidney Fussell / The Atlantic:

Sidney Fussell / The Atlantic:

Automation may not completely replace service workers, but will likely reduce hours, lower pay, and conceal intense demands on labor and poor working conditions — Workers may not be replaced by robots anytime soon, but they'll likely face shorter hours, lower pay, and stolen time.

![]() Washington Post:

Washington Post:

Over half of the top 20 YouTube search results for “RBG” this week pointed to conspiracy-theory videos about Ruth Bader Ginsburg's health — Conspiracy theories about the health of Supreme Court Justice Ruth Bader Ginsburg have dominated YouTube this week, illustrating how the world's …

![]() David Pierce / Wall Street Journal:

David Pierce / Wall Street Journal:

How MicroLED display technology, demoed by Samsung at CES, may let customers assemble their own TVs to the exact size and shape they want, like Lego bricks — MicroLED is better looking, more efficient and more versatile than any previous display tech. Now all Samsung, Sony …

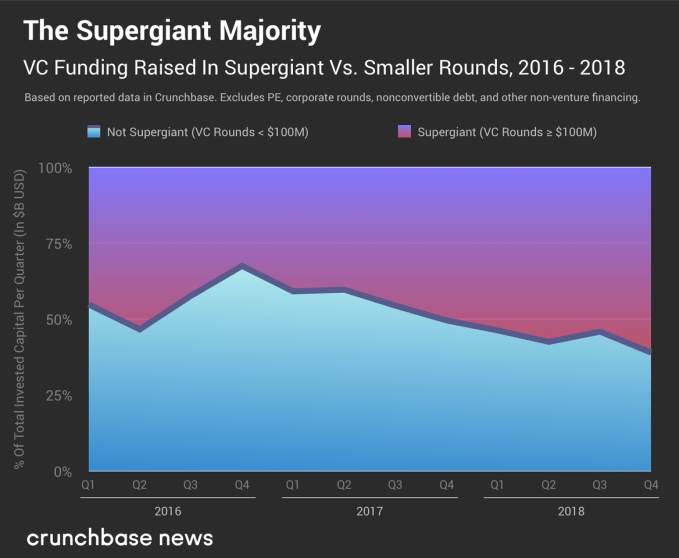

For the global VC industry, 2018 was a supergiant year. Crunchbase projects that 2018 deal and dollar volume surpassed even the high-water mark left by the dot-com deluge and the drought that followed.

As covered in Crunchbase News’s global VC report reviewing Q4 and the rest of 2018, projected deal volume rose by 32 percent and projected dollar volume jumped 55 percent since 2017. For all of 2018, Crunchbase projects that well over $300 billion was invested in equity funding rounds across all stages of the venture-backed company life cycle. (This figure includes an estimate of transactions that were finalized in 2018, but won’t be publicized or added to Crunchbase until later. More on how Crunchbase projects data can be found at the end of that report.)

Is the market mostly buoyed by the billions raised by the biggest private tech companies, or is a rising tide in this extended aquatic metaphor raising all ships? In other words, is the bulk of the capital going to only a handful of the largest rounds? That’s what the numbers show.

In the global VC pool, capital is definitely sloshing toward rounds totaling $100 million or more. In the chart below, you can see what percent of reported global VC dollar volume was raised in “supergiant” rounds versus deals of smaller size.

In the year, over 56 percent of worldwide dollar volume can be attributed to supergiant rounds. With 61 percent of reported capital coming from supergiants in the final quarter, Q4 2018 has the highest concentration of supergiant dollar volume of any single quarter on record.

Following that same theme, the calendar year 2018 is the most concentrated year on record. In the chart below, we show how much capital was raised in non-supergiant (<$100 million) venture rounds over the past decade. (It’s basically the bottom part of the first chart, with the data aggregated over a longer period of time.)

For the first time in at least a decade (and likely ever) supergiant, $100 million+ VC rounds accounted for a majority of reported capital raised. So in summary: Q4 2018 had the highest share of supergiant VC dollar volume on record, and 2018 was the most concentrated year on record.

On the one hand, the results are not surprising, considering that the biggest-ever VC round (a preposterously large $14 billion Series C raised by Ant Financial) and several rivals for that top spot were closed last year. That big round made a big splash. It was the year of multi-billion-dollar global growth funds, SoftBank and scooter CEOs worth supergiant sums, at least on paper. But was it good for the smaller players too?

Seed and early-stage deal and dollar volume were both up in 2018, but then again, so is everything toward the end of a bull market cycle. The question is, when the bottom falls out, between supergiant and more normal-sized rounds, which has the farthest to fall?

![]() Emma Best / Gizmodo:

Emma Best / Gizmodo:

An overview of the data the US government collected on internal workings of WikiLeaks from 2009 at least through 2017, including chats identifying some sources — Late last year, the U.S. government accidentally revealed that a sealed complaint had been filed against Julian Assange, the founder of WikiLeaks.

Just as on-demand electric scooters are trying to pick up speed in Europe, one of the scooter market’s most ambitious startups has halted operations in one country after its e-scooters started halting mid-ride, throwing off and injuring passengers.

Lime, the Uber-backed bike and scooter rental company that is reportedly raising money at between a $2 billion and $3 billion valuation, has pulled its full fleet of scooters in Switzerland, in the cities of Basel and Zurich, for safety checks after multiple reports of people injuring themselves after their scooters braked abruptly while in use.

The company sent out a notice to users — presented in screenshots below, in German, with the full text translated underneath that — noting that it is currently investigating whether the malfunction is due to a software fault, where an update of the software causes a scooter inadvertently to reboot during a ride, thus engaging the anti-theft immobilization system.

To make up for the disruption in service, it’s offering users a 15-minute credit that they can use when the service is restored, but it doesn’t give an indication of when that might be.

[gallery ids="1768613,1768614,1768615"]The text reads as follows:

By now you surely have heard from the media that we have taken all Lime scooters into our workshops and have temporarily paused the service.We have been made aware of cases in which users report that during their rides, sudden brake maneuvers take place, leading to crashes. The security of our users is our top priority and this is why we decided at the start of this week to pull in all devices and do a thorough security and quality check on them.The investigation is ongoing. After first hints, we are currently examining whether a software update could be causing a reboot during the ride, triggering the theft protection. We have already taken measures to ensure this will never happen again. Nonetheless, we are testing each device thoroughly to ensure that no software or hardware issues remain.We are optimistic that we will soon again be operating on the streets of Zurich and Basel and apologize for the disruption of the service. To make up for it, we offer you a free 15 minute ride with code “LIME-ON-SCHWEIZ”. As soon as we are back again.We will keep you updated about the developments. Thank you for your understanding.With lime green greetingsYour Lime Switzerland Team

We have reached out to Lime for more details and will update this post as we learn more.

The cessation of service comes after reports over the past several months detailed how users have been injured after their Lime scooters stopped abruptly. In November, a doctor broke his elbow after the speedometer on his vehicle failed, the brakes kicked in, and he was thrown into the air. (Fortunately, this happened in front of the hospital, where he also worked.)

Another rider dislocated his shoulder after falling over his Lime scooter’s handle bars when travelling at about 25 km/h (about 15 mph). A third suffered cuts and bruises in a similar incident to the other two: abrupt braking while travelling.

Lime launched e-scooter services in several cities across Europe last summer, starting in Paris with aggressive ambitions to expand its business to 25 cities in Europe by the end of 2018.

In Switzerland Lime has (had?) about 550 scooters in operation. But overall, Lime hasn’t quite hit its wider regional target. It is currently live in 18 cities in Europe, and not all of those have electric scooters.

In the UK, for example, Lime has had a limited roll out of electric bikes and there are no plans at the moment to add scooters.

Part of the reason in the UK is because that particular mode of transportation is facing some regulatory hurdles: technically they are classified as vehicles, and therefore illegal to drive without licenses on public roads. On the other hand, there are plenty being sold and in use by private individuals who may or may not have the right credentials to use them, and regulations may get revisited.

One of Lime’s biggest competitors, Bird, launched e-scooters in London last year, but it has been a very limited roll out, on private land on the Olympic campus.

In other markets, Lime originally launched scooters but has since had to halt its business. In December, Lime, along with rivals Wind and Voi, were all ordered to halt e-scooter operations in Madrid, after the city determined that they were posing a safety hazard after a series of accidents, including a death, amid other safety concerns.

We’ll update this post as we learn more. Overall, however, the development does not paint a very positive picture.

Even before we’ve seen a mass launch of actual services, the e-scooter market in Europe is already very crowded with hopeful players. Alongside Lime and Bird flying over from the US, there are also homegrown startups like Taxify, Dott, Wind and Voi, as well as transportation behemoths like VW, all entering the fray.

All fine and well, I suppose — let the best man win and all that — but seeing early versions of these services getting banned by authorities or halted by the companies themselves over accidents does make one wonder if safety is getting compromised in the name of aggressive competition in new, unchartered areas of “disruptive” tech.

The government shutdown entered its 21st day on Friday, upping concerns of potentially long-lasting impacts on the U.S. stock market. Private market investors around the country applauded when Uber finally filed documents with the SEC to go public. Others were giddy to hear Lyft, Pinterest, Postmates and Slack (via a direct listing, according to the latest reports) were likely to IPO in 2019, too.

Unfortunately, floats that seemed imminent may not actually surface until the second half of 2019 — that is unless President Donald Trump and other political leaders are able to reach an agreement on the federal budget ASAP. This week, we explored the government’s shutdown’s connection to tech IPOs, recounted the demise of a well-funded AR project and introduced readers to an AI-enabled self-checkout shopping cart.

1. Postmates gets pre-IPO cash

The company, an early entrant to the billion-dollar food delivery wars, raised what will likely be its last round of private capital. The $100 million cash infusion was led by BlackRock and valued Postmates at $1.85 billion, up from the $1.2 billion valuation it garnered with its unicorn round in 2018.

2. Uber’s IPO may not be as eye-popping as we expected

To be fair, I don’t think many of us really believed the ride-hailing giant could debut with a $120 billion initial market cap. And can speculate on Uber’s valuation for days (the latest reports estimate a $90 billion IPO), but ultimately Wall Street will determine just how high Uber will fly. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

N26, a German fintech startup, raised $300 million in a round led by Insight Venture Partners at a $2.7 billion valuation. TechCrunch’s Romain Dillet spoke with co-founder and CEO Valentin Stalf about the company’s global investors, financials and what the future holds for N26.

Bird is in the process of raising an additional $300 million on a flat pre-money valuation of $2 billion. The e-scooter startup has already raised a ton of capital in a very short time and a fresh financing would come at a time when many investors are losing faith in scooter startups’ claims to be the solution to the problem of last-mile transportation, as companies in the space display poor unit economics, faulty batteries and a general air of undependability. Plus, Aurora, the developer of a full-stack self-driving software system for automobile manufacturers, is raising at least $500 million in equity funding at more than a $2 billion valuation in a round expected to be led by new investor Sequoia Capital.

WeWork, a co-working giant backed with billions, had planned on securing a $16 billion investment from existing backer SoftBank. Well, that’s not exactly what happened. And, oh yeah, they rebranded.

After 20 long years, augmented reality glasses pioneer ODG has been left with just a skeleton crew after acquisition deals from Facebook and Magic Leap fell through. Here’s a story of a startup with $58 million in venture capital backing that failed to deliver on its promises.

7. Data point

Seed activity for U.S. startups has declined for the fourth straight year, as median deal sizes increased at every stage of venture capital.

Key takeaways:

1. Seed activity for U.S. startups declined for the fourth straight year

2. Median U.S. seed deal was the highest on record in Q4 at $2.1M

3. Seed activity as a % of deals shrunk to 25%

4. Companies securing seed deals are older than ever https://t.co/exr8DRQRAF— Kate Clark (@KateClarkTweets) January 9, 2019

8. Meanwhile, in startup land…

This week edtech startup Emeritus, a U.S.-Indian company that partners with universities to offer digital courses, landed a $40 million Series C round led by Sequoia India. Badi, which uses an algorithm to help millennials find roommates, brought in a $30 million Series B led by Goodwater Capital. And Mr Jeff, an on-demand laundry service startup, bagged a $12 million Series A.

9. Finally, Meet Caper, the AI self-checkout shopping cart

The startup, which makes a shopping cart with a built-in barcode scanner and credit card swiper, has revealed a total of $3 million, including a $2.15 million seed round led by First Round Capital.

Want more TechCrunch newsletters? Sign up here.