Brolly, the U.K. insurance app that lets you keep track of your various policies so that you are correctly and competitively covered, is launching a new product to plug what it sees as a gap in home contents insurance.

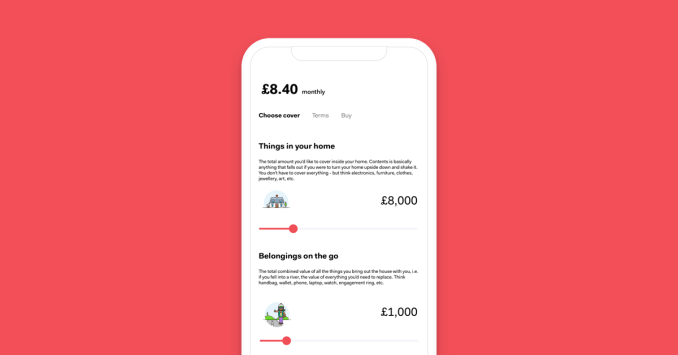

Dubbed “Brolly Contents,” the new offering promises “flexible” monthly cover for all or a subset of the items you own, transparently priced and delivered in a more convenient way via Brolly’s mobile app. Features of Brolly Contents include the ability to insure up to £40,000 worth of belongings, suitable for renters or property owners, and no fees for updates to your cover.

In addition, there’s a promised loyalty discount of up to 25% that increases each month you stay with Brolly and haven’t made a claim. That’s the antithesis to incumbent providers who offer large discounts for new customers, which are then clawed back the following years on the premise that you are too lazy or time poor to bother switching.

Brolly founder and CEO Phoebe Hugh tells me her aim is to rid customers of what she calls the “loyalty tax,” while simultaneously upgrading contents insurance for the digital age.

“For the majority of consumers, contents insurance is the first voluntary insurance product they will come across,” says Hugh. “A digital native generation are approaching this for the first time and are confused and unhappy with what is currently available. 9 out of 10 households headed by someone between 65-75 have contents insurance, versus just 4 out of 10 of under 30’s. This newer customer has become accustomed to digital delivery of everything, from banking to food delivery, and cannot find an insurance product that suits them. Brolly Contents is the first Brolly product to address these problems head on”.

Developed in partnership with specialist insurer Hiscox, Brolly Contents promises to be more flexible than similar products after Hugh and her team concluded that the current market wasn’t meeting existing Brolly customers’ needs, let alone expanding the market for contents insurance as a whole.

Contents insurance is typically sold as blanket cover but with lots of caveats, and/or requires tedious form filling and is still opaque at best. This leaves many not bothering to take out cover at all or discovering that the cover they have falls short when it’s time to make a claim.

In contrast, Brolly Contents claims to be more transparent, with a much simpler to understand product and an on-boarding experience delivered via in-app chat that walks you through how much cover you require and the amount of excess you wish to pay should you make a claim.

“With Brolly Contents, you can choose how much you want to insure and it doesn’t need to be everything in your home,” says Hugh. “You can get insured from as little as £4.50 a month, if you only want to protect a few things. There are no add-ons, and you can add valuables for no additional cost. Many businesses in this space, particularly some of the newer ones, are offering a branded product to customers which, in the background, consists of multiple underwriters with policies stitched together. As soon as you add some valuables and accidental damage, the price skyrockets. It’s pretty tricky to keep pricing competitive if this is how you operate”.

Meanwhile, Hugh — who before starting Brolly was an underwriter at Aviva — says that despite the insurtech hype, the insurance industry remains a “pre-disrupted market”. Incumbents are focused on where the profit currently is, and therefore the uninsured or beginner insurance customers aren’t well served. In the meantime, insurtech startups typically have to work with those same incumbents.

“A new business gaining traction in insurance is challenging; it’s unlikely you can underwrite yourself at the outset so you have to take a patient approach,” she says. “We found a world-class underwriting partner in Hiscox who shared our vision to simplify insurance, and who wanted to challenge the status quo, but are also trusted to pay out on claims. We’ve been working on Brolly Contents for over a year to deliver something genuinely new”.

Adds Matt Churchill, Head of Hiscox Futures: “Consumer expectations of insurance are changing. We identified early on that Brolly were leading the charge in exploring new ways of engaging customers. Together, we’ve designed a simple insurance product and brought it to life on Brolly’s proven technology driven platform. We hope it brings positive benefits to consumers looking for simplicity and flexibility from a home contents policy”.

from TechCrunch https://ift.tt/2YAaeys

No comments:

Post a Comment