“5G and the enterprise opportunity: How leading operators are developing ecosystem, cloud, and AI strategies for winning in 5G” is an MIT Technology Review Insights report that examines how operators are transforming their business and technology environments to deliver 5G enterprise services, particularly focusing on cloud, automation, and the ecosystems that are emerging to drive digital transformation across industries. The report was produced through interviews with heads of IT, 5G business solutions, and platform innovation at Vodafone Business, Deutsche Telekom, AT&T, Vodacom, Rogers Communications, SK Telecom, Telia Company, SmarTone, and Korea Telecom.

This report was written by Insights, the custom content arm of MIT Technology Review. It was not produced by the editorial team.

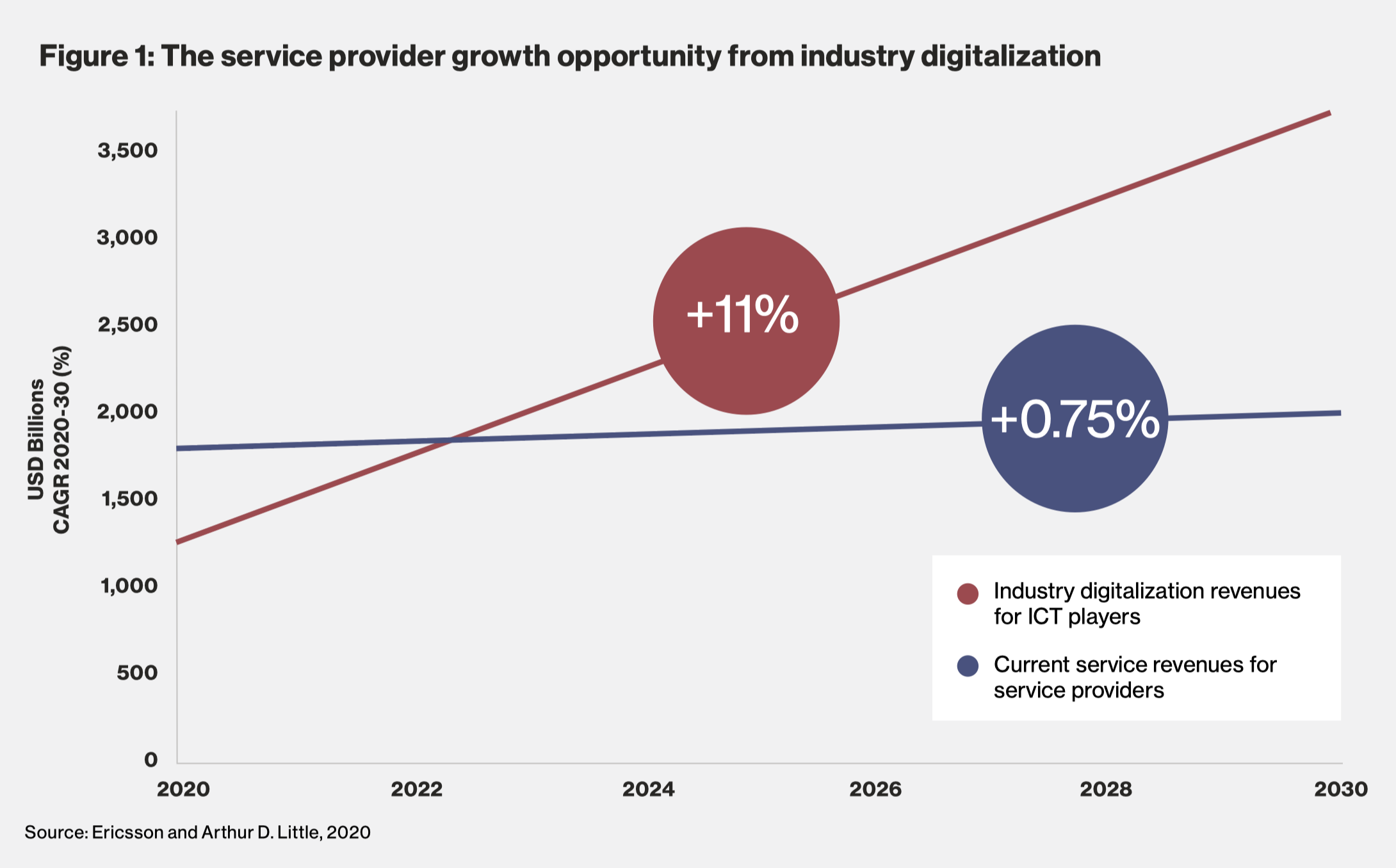

Unlike previous generations of network technology that paved the way for innovations like smartphones and wireless broadband, 5G’s tremendous improvements in terms of lower latency, faster transmission speeds, and vastly increased network capacity are throwing open the doors to large-scale enterprise digital transformation. For operators, 5G represents yet another investment cycle—one where monetization requires making strategic bets on technology, platforms, business models, and partners. However, with 11% CAGR forecast for the value-added services market between 2020 and 2030 compared to a 0.75% CAGR for current existing services, 5G is a considered a leading source of new revenue for the industry. Leading operators are playing to their strengths and understand that delivering transformational enterprise solutions involves working in ecosystems of complementary capabilities.

Not just another G

Executives interviewed for this report argue that the most compelling market opportunities for 5G are in enterprise and public sector digitalization programs. These involve drawing on 5G’s powerful capabilities around throughput, mobility, reliability, latency, and data volume to host and manage a rich set of applications and technology functions across an exploding set of potential uses in sectors such as health care, manufacturing, construction and engineering, mining, agriculture, retail, events and public spaces, transportation, smart cities, and resource management. Yet delivering these capabilities, particularly at scale, requires an enormous shift for operators in terms of culture and skills, business model, architecture, and technical capabilities.

“5G is not just another G. It’s definitely not ‘4G plus one.’ It’s the foundation for the new real-time economy,”

Alexander Brock, senior vice president of technology strategy, innovation, and partnerships, Rogers Communications

“5G is not just another G. It’s definitely not ‘4G plus one.’ It’s the foundation for the new real-time economy,” says Alexander Brock, senior vice president of technology strategy, innovation, and partnerships at Rogers Communications in Canada. “For the first time there are new capabilities in wireless that are truly transformational, such as variable bit rate capabilities, differential latency on demand, the ability to push transactions to the edge, and to spin up customized services through capabilities like network slicing. These are more likely to see the light of day in the enterprise market than they are in the consumer market, at least initially.” The challenges in this migration, says Brock, are technical as well as operational—taking networks and IT systems that were largely homogenous to ones that are fully customizable.

Heading deeper into customer value chains

Becoming a digital transformation partner is taking operators deeper than ever before into their customers’ businesses—the digital and the physical. Customer solutioning involves exploring customer requirements and use cases, then learning what the actual operating environment looks like. “Funnily enough, the second one is actually often harder than the first,” says Ryan van den Bergh, head of technology architecture at Vodacom in South Africa, particularly in mining environments that might be underground and have various physical or technological obstacles.

SmarTone in Hong Kong developed a number of industry verticals when it launched 5G in May of this year, focusing on the construction, hospitality, and property sectors—Hong Kong’s largest industry opportunities. Chief Technology Officer Steven Chau emphasizes the importance of discussing value over products in enterprise solution design. “We may be selling smart helmets or water sensors, but we don’t talk (to customers) about IoT. We talk about their user experience or their operational climate. At the end of the day, customers are not looking for a sensor here and therethey’re looking for a solution that can help them with their pain points.”

“It’s not about 4G or 5G, it’s more a question about what type of value do we enable to the customer in their digital journey,” says Lars Klasson, 5G program manager at Telia, the largest fixed-line, mobile, and broadband operator in Scandinavia and the Nordic countries.

While some level of industry alignment is emerging organically within operators’ enterprise business divisions, becoming too deeply focused on verticals at this time can be limiting, says Yoon Kim, chief technology officer at SK Telecom. “There are strategic verticals that we want to focus more on,” such as health care and manufacturing, “but we don’t want to be constrained by a ‘vertical-by-vertical’ approach.” The risk, he says, is missing out on 5G applications with broader industry appeal and potential.

From homogeneity to heterogeneity

Abdurazak (Abdu) Mudesir, senior vice president of service and platform at Deutsche Telekom, notes the difficulty of providing customized offers to numerous different vertical industries. “The heterogeneity of client requirements is a challenge: you have completely different verticals, and while there are some commonalities, there are also huge differences. For a service industry like ours that tries to develop mass-market offerings, this much customization is not easy. To offer dedicated enterprise networks in a cost-effective way, you need to work with many different and specialized partners.”

Rogers Communications in Canada is building specific IoT expertise in automotive, natural resources, fleet management, smart cities, and asset management, but generally the strategy is also to build a solution-neutral enterprise service delivery organization, based on servicing multi-cloud requirements and through open APIs.

Focusing too much on specific use cases could become a distraction, particularly an over-emphasis on individual use cases, says Brock. Rather, he says, “We are making the investments inplatforms and IT systems to create the ‘network as a platform.’” This means having most customer requests as ready-to-go, off-the-shelf solutions, he says, and helping customers plug in and innovate. “It’s about building a series of foundational capabilities and allowing applications to flourish on the network. We are not going to be the experts in every vertical—what we need is to be experts in having an exposed set of capabilities to allow those verticals to plug into us.”

Operators aim to deliver about 80% of enterprise requests through off-the-shelf solutions, leaving just 20% in need of a customized response.

Partnerships and the 5G ecosystem

Addressing the seemingly infinite number of enterprise opportunities, with all of their hardware and software complexities, means that operators cannot go it alone. A central feature of the shift to 5G is the partnerships and ecosystems that are evolving to meet customers’ unique and complex goals for digital transformation.

This is a significant shift in roles for most operators. In days gone by, enterprise sales teams sold subscriptions to connectivity services. Now, says Chau at SmarTone, “They need to understand the entire customer journey, and how to meet all their IT and communication network requirements. This is quite different from what a telco used to be.” Doing it alone is no longer an option, and success for operators in the 5G era increasingly depends on the strength and range of their ecosystem partners that they are working with.

“Managing this [5G] ecosystem is probably the thing which requires the most thought and management. One of the biggest challenges is the huge number and variety of customer requests that are coming through. It is exciting, but it also stretches any single carrier’s ability to manage the volume.”

Justin Shields, chief technology officer, platforms and solutions at Vodafone Business

Justin Shields, chief technology officer, platforms and solutions at Vodafone Business, whose team is currently working on hundreds of enterprise opportunities, notes that the sheer breadth of components within 5G enterprise services requires operators to work within in an ecosystem. “Managing this ecosystem is probably the thing which requires the most thought and management. One of the biggest challenges is the huge number and variety of customer requests that are coming through. It is exciting, but it also stretches any single carrier’s ability to manage the volume.” The complexity of the requests comes from the fact that they cut across devices (with security implications), applications that are often running at the edge, business processes, and on top of that, many require change management on the customer’s side.

Ecosystem investments, choices, and trade-offs

As 5G ecosystems evolve and mature, there are a number of choices and trade-offs that operators need to make. A key learning at Telia, says Klasson, is the importance of working within customers’ own ecosystems. “What system integrators do they already use? What type of application providers or hardware providers do they use? You can try to speculate what type of ecosystem or partnership you need, but then when you are hands-on in the deal with the customer, they come to the table with their preferred partners already.”

Another choice is in how much to rely on the technical or platform capabilities of partners versus building them in-house. In addition to cultivating mutually beneficial relationships with public cloud hyperscalers, says Kim, SK Telecom has invested in a joint venture with HP Enterprise to develop its own MEC platform with software and hardware that can be offered to operators in Southeast Asia that are just starting out on their 5G journeys.

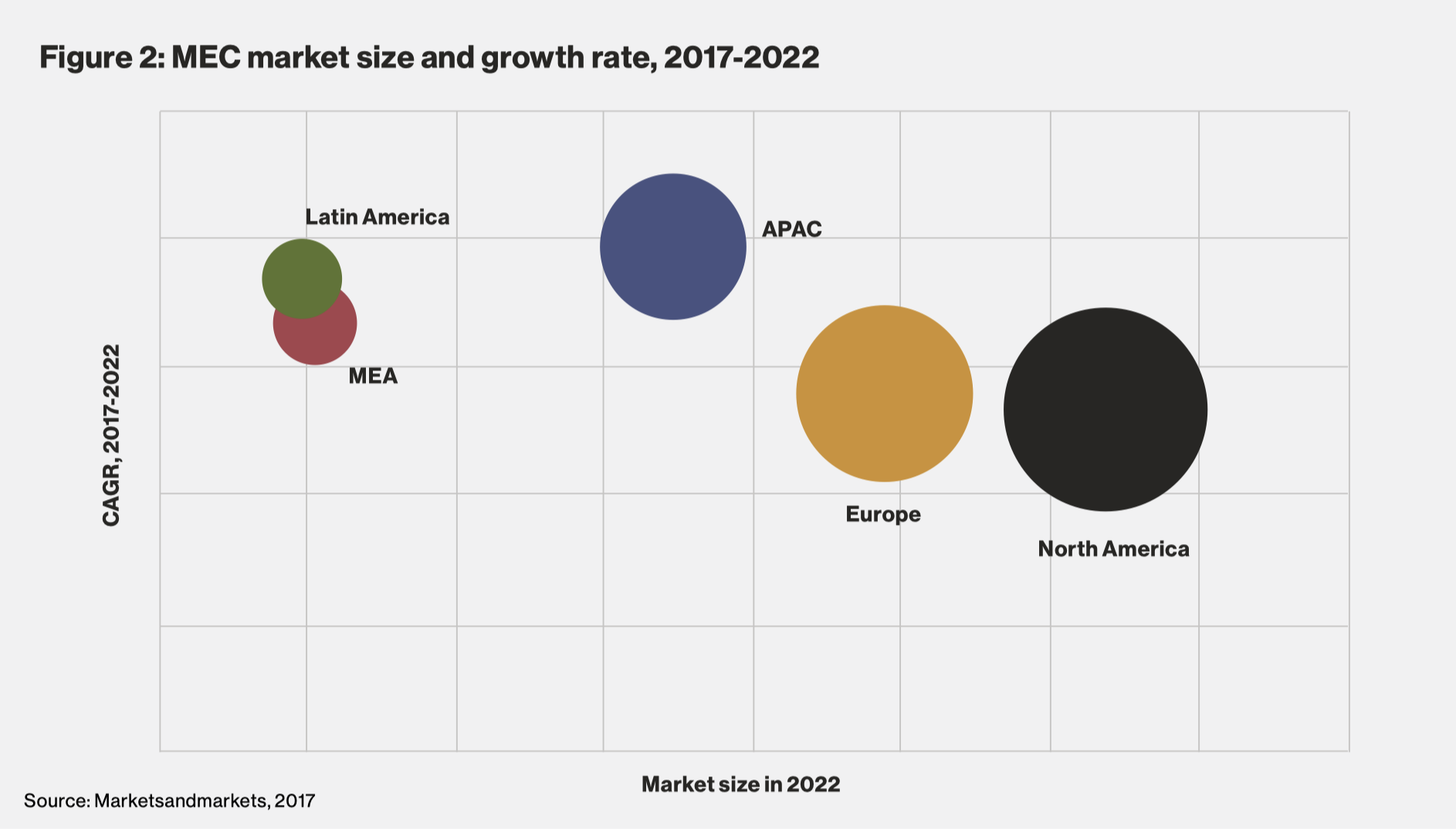

“We see this as an interesting mobile operator play where, in addition to partnering with hyperscalers, which we are doing actively, we can also build an ecosystem of our own, based on our 5G network, partnerships with third-party solution providers, robot makers, smart factories, and other device players to make a valid and viable new ecosystem,” says Kim. Indeed, the MEC market is estimated to be growing at 35.2% annually according to Markets and Markets, with Asia growing the fastest.

“There are not too many operators that have all the ingredients—the connectivity, the edge offering, and also the IT services,” says Abdu Mudesir, which is why Deutsche Telekom is also developing all three. This allows customers to run their networks in isolation if necessary and enables Deutsche Telkom to layer on managed IT services. “Having all of these capabilities is what can make an operator really unique.”

APIs and the path to monetization

In contrast with the closed, monolithic models of the past, successfully operating within a 5G ecosystem—and indeed monetizing 5G—can only be accomplished with a disaggregated architecture and open interfaces. With a whole suite of new 5G capabilities, says van den Bergh at Vodacom, the question becomes, “How do we expose them best, in order to monetize the network? Standardized APIs, external API gateways, making sure that the architecture is completely open—these are fundamental requirements.”

At Rogers in Canada, this has led to a “services factory” approach for developing standardized services and API interfaces exposed through common platforms to enable easy consumption for enterprise customers, allowing them to plug into the network. IT systems must also be as simple as possible, with a playbook, as opposed to everything being custom.

Operators interviewed for this report say that monetization and the division of value between partners are still agreed on a case-by-case basis.

5G provides a new impetus for cloud

ver the past few years, operators have been reducing cost and simplifying legacy network infrastructure and operational processes by moving applications into the cloud. With 5G opening the door to closer collaboration with enterprise customers and broader ecosystem innovation, cloud takes on a whole new level of importance. Indeed, cloud is at the center of operator strategy for enterprise 5G.

Cloud-based resources are critical to the working of ecosystem partnerships, for delivering enterprise services such as MEC and SD-WAN, and for supporting platforms that allow developers to scale services up and down through API-exposed network functions. The speed, flexibility, and openness of cloud architecture enable operators to more simply manage their IT operations and network services. Cloud also facilitates access to automation and AI tools, advances that drive performance in IT operations and network management and generate the data that comprise much of 5G’s intrinsic enterprise value.

Operators interviewed for this report state that their “cloud-first” strategies cover the network, IT operations, and also internal IT systems, although these are at different stages of migration. They agree that the end goal is to move as many network and IT functions to the cloud as possible. However, there are different streams, priorities within those, and a fully 100% cloud-native environment may not be achievable or desirable.

“We rely on the cloud to deliver all of our technologies—we absolutely need cloud technology to give us the scale and the flexibility we need to deal with these solutions,” says Shields at Vodafone Business, pointing out that access to the cloud is also an increasingly pervasive requirement for enterprise customers. Yet selecting a particular cloud service should be a function of the cost, performance, or footprint required for each application. “Whether it’s on a public cloud or our own private cloud, it’s just a question of ‘Is it running right?’”

Getting to cloud native may not be possible given specific technical parameters, says Shields. “We operate in a hybrid world: sometimes using physical, on-premise, traditional infrastructure, and sometimes cloud native running in our private cloud, and then other times running natively in the public cloud.” Over the past five years, Vodafone has migrated 50% of its EU network and 65% of IT applications into the cloud. The migration path has been to move applications that are least risky first, and with cloud technology rapidly maturing they have been able to accelerate these efforts.

Determining cloud priorities

AT&T’s cloud migration plan has categories for all network and IT functions that help determine the speed at which they will be moved to the cloud. The first category includes enterprise functions that need to be retired. The second includes non-latency-dependent applications that can be moved to one of the operator’s six remaining data centers (rationalized down from 28). The third and fourth categories are applications that can be virtualized and containerized, respectively. The fifth category is applications that can be moved to a fully cloud-native state: microservice-based, data-driven, and fully automated.

“First and foremost, everything has to have a business rationale. The decision to take a function to cloud native has to be based on what’s most important for the business.”

Sorabh Saxena, executive vice president, customer service and operations at AT&T Business

When evaluating these categories, says Sorabh Saxena, executive vice president, customer service and operations at AT&T Business, “First and foremost, everything has to have a business rationale. The decision to take a function to cloud native has to be based on what’s most important for the business.” This requires close collaboration between the relevant business unit and technology leaders. Among the more challenging are “chatty applications” (with high intersystem dependency) that produce and exchange persistent data across multiple cloud zones or geographic nodes. These can consume more cloud resources and drive up expenditure on public cloud services.

The current challenges around cloud migration focus on application readiness, risk of destabilizing the legacy environment, cost implications, and security implications of different cloud technologies. As a result, operators are being pragmatic, developing hybrid-cloud environments and managing multiple clouds. It is possible that in the future delivering enterprise services across this cloud environment will become a source of complexity for operators, and they may look to further best practices in how to manage cloud resources and optimize their operations.

Getting ahead of operational complexity

Even prior to the 5G era, complexity management was a key driver for trends such as automation and outsourcing. 5G and the accompanying surge in enterprise connectivity is rapidly accelerating this trend. Neither the network nor the IT operations can be managed without almost full automation, say leading operators.

“Automation is everywhere; coupled with AI, it is critical to everything that we do, given the scale and complexity of our network and operations,” says Andre Fuetsch, president AT&T Labs and chief technology officer at AT&T. “The industry is developing far more distributed computing environments—the mobile packet core becomes far more distributed than in previous generations. And when you’re dealing with so many different functions that you have to manage on a higher and more-distributed scale, you have to have automation built in.”

Automation provided the agility for AT&T to scale effectively during the coronavirus pandemic. In March 2020, the huge shift to remote working led to a 25% spike in enterprise call volumes over home WiFi networks. A traffic management crisis was averted because automated network functions and components were able to spin up in a matter of hours.

Automation, AI, and enterprise SLAs

SLA requirements around reliability and latency will require operators to have a high degree of control over service quality to resolve issues in close to real time. This is critical because, as Abdu Mudesir at Deutsche Telekom points out, smart factories and other Industry 4.0 enterprise services are reliant on high-performance computing and analytics that drive up customer service expectations. “Availability KPIs [key performance indicators] for 5G are really much higher than our network KPIs today, and those or other SLAs cannot be managed manually. You need to fully automate incident management and root-cause analysis,” as it would be unworkable to do these tasks by going through incidents log-by-log. Automated root-cause analysis allows operators to shift toward predictive, proactive SLA management, meaning the detection and prevention of anomalies before they happen.

Saxena at AT&T describes how their AI analytics platform capabilities are used for the enterprise customer experience. The AI platform has been in development over the past year and seeks to track performance against the “top moments that matter” for enterprises and even extends to industrial IoT. By understanding the customer’s experience and satisfaction with service elements such as ordering, contracting, and pricing, says Saxena, “we can analyze when a customer’s SLA is potentially not being met.” The system then proactively recommends next-best actions for resuming SLA compliance, as well as “preventing the slide of the customer from a promoter to a detractor.”

Conclusion

Just a year after it was first introduced (and much of that dominated by a global pandemic), the telecommunications industry’s hesitation around the potential use cases and monetization strategy for 5G is fading away. Whether or not enterprise customers actually need all of 5G’s advanced capabilities right now, the hype around it is opening the door to deeper collaboration with customers, a strategic seat at the table with ecosystem partners, and an avenue for deriving value from innovation. The findings of the report are as follows:

- Enterprise service strategy will occupy the greatest amount of CIO mindshare. The questions of “where to play” and “how to play” will remain critical for operator CIOs and enterprise business heads. These questions will shape decisions about which partnerships to form, which technical capabilities to build or acquire, and how to capture the most value from enterprise services. Operators must decide how much they want to focus on standard versus customized solutions, and how much vertical expertise or application development expertise they want to build up, as well as relying on partners.

- Cloud is the platform for 5G. Operators with serious ambitions for 5G have a cloud-first strategy for the network and IT. Indeed, the ease of working in operators’ cloud environments is a differentiator for enterprises, developers, and other ecosystem participants. Yet the mix of cloud technologies is continually evolving as operators look to optimize the balance of public and private clouds, taking advantage of the best available technology while also evaluating the costs and risks. And a fully cloud-native environment may remain out of reach. An emerging challenge will be to manage different cloud components and ensure a seamless experience across clouds, to avoid silos building up again.

- Reach for simplicity, prepare for complexity. While some challenges in the 5G journey are known, others are yet to emerge. The full impact on operations is not known yet—the real challenge of delivering “five-nines” SLAs or the complexity that will emerge from having hundreds of APIs. Leading operators view automation and AI as central to managing operations efficiently, cost effectively, and at scale. Operators must give thought to the types of challenges that they will face once 5G enterprise services really scale and prepare their environment for that future.

Download the full report.

from MIT Technology Review https://ift.tt/2SBse64

No comments:

Post a Comment