What Movie Series Were The First Themed LEGO Building Sets Based Off Of? |

|

Think you know the answer? |

|

from How-To Geek https://ift.tt/2DVuZsB

What Movie Series Were The First Themed LEGO Building Sets Based Off Of? |

|

Think you know the answer? |

|

New York Times:

US officials: China's cyberespionage against the US, which was pared back in 2015 after US-China pact, picked up again in 2017 and has accelerated since then — WASHINGTON — Three years ago, President Barack Obama struck a deal with China that few thought was possible …

Jason Del Rey / Recode:

How Amazon is limiting the ability of popular brands to sell independently via its Marketplace, if they also want to sell their goods directly via Amazon itself — Some companies are choosing to end their relationship with Amazon rather than cave to the online retailer's demands.

Simone Stolzoff / The Atlantic:

PitchBook: VCs invested ~$8B in Brazil, Chile, Colombia, India, Indonesia, Malaysia, Mexico, and Pakistan in first 10 months of 2018, 40% more than in all 2017 — Entrepreneurs such as Sidra Qasim and Waqas Ali exemplify the increasing ease of accessing venture capital from the developing world.

Facebook is still dealing with the fallout from a New York Times report outlining the company’s strategy to fight back against criticism, particularly its work with Definers Public Affairs, an opposition research firm with ties to the Republican Party.

That work included a document that Definers sent to reporters suggesting ties between George Soros and progressive political groups criticizing Facebook. The Times story described the broad strokes of the claims made by Definers, but the document itself has not been shared with the public — until today, when it was published by BuzzFeed.

At this point, the contents aren’t particularly revelatory, but the document is still worth reading, since it’s at the center of the recent controversy.

It’s titled “Freedom From Facebook Potential Funding,” and it begins:

Recently, a number of progressive groups came together to form the Freedom From Facebook campaign which has a six-figure ad budget. It is not clear who is providing the large amount of funding for the campaign but at least four of the groups in the coalition receive funding or are aligned with George Soros who has publicly criticized Facebook. It is very possible that Soros is funding Freedom From Facebook.

The document goes on to point out connections between Soros and several of the groups involved in Freedom From Facebook, and it notes Soros’ public criticism of Facebook and Google. On its own, the document seems “largely innocuous” (as BuzzFeed put it), but it’s become controversial for potentially playing into anti-Semitic conspiracy theories about Soros.

A Freedom From Facebook spokesperson has said that no money from Soros was used to fund the campaign — in fact, Axios reported that its initial funding came from David Magerman, a Pennsylvania-based philanthropist and former hedge fund executive.

According to BuzzFeed, this is one of at least two documents that Definers prepared after Soros made critical remarks about Facebook and Google at Davos.

Meanwhile, CEO Mark Zuckerberg and COO Sheryl Sandberg have denied knowledge of Definers’ work for Facebook, and outgoing head of public policy Elliot Schrage took responsibility for hiring the firm. But Facebook later acknowledged that Sandberg had asked the communications team to research Soros’ financial ties after he criticized the company, and reporting by my colleague Taylor Hatmaker suggests that Sandberg was more aware of Definers’ work than initially acknowledged.

When reached for comment, a Facebook spokesperson pointed us to Schrage’s post and said the company has nothing further to add.

There’s quite a bit wrong with real estate in Brazil, according to QuintoAndar founder and CEO Gabriel Braga. Those seeking long term rentals in big Brazilian cities like São Paulo and Rio de Janeiro are throttled by bureaucratic policies that enforce outrageously expensive deposits, the requirement of local cosigners and sky-high insurance fees. On the supply side, amateur landlords are tunnel visioned on making money from transactions, creating a low quality of service and many wasted hours of apartment hunting for tenants.

This is where QuintoAndar, a São Paulo-based rental marketplace, comes in. Now, the 600-person company has raised a $64 million (R$ 250 million) round led by General Atlantic to accelerate expansion in Brazil. Existing investors Kaszek Ventures, Qualcomm Ventures and QED also participated in the round.

Marketplaces like OLX, Craigslist and VivaReal all surface listings for rentals in Brazil. But QuintoAndar wants to set itself apart as an end-to-end service that lets users search, book, rent and advertise rental properties. The site provides the listings, allows users to schedule tenant visits to the property (the founder says more than 86,000 property showings were booked in October), and processes the transactions. Landlords and tenants negotiate through the platform, where they also sign the contract. Braga says this process is much easier than working with – and paying for – an agent. QuintoAndar guarantees landlords that they’ll get rent every month as well as protection against any damages the renter may make to a property. Contracts are digitized and renters don’t need to physically go to a notary to finalize a contract, allowing landlords to be anywhere. If a property needs a repair or maintenance, users can tap into QuintoAndar’s network of service providers through the site.

The company believes there’s a big opportunity to make renting in Brazil more efficient. “20% of the population in Brazil lives in rented properties, and the sentiment toward buying homes in Brazil is changing,” says Braga, citing data from the Brazilian Institute of Geography and Statistics. Brazilians are seeing home ownership as less of a long term goal and are opting to rent, meaning more money in the bank and freedom to relocate.

Brazil remains undercapitalized relative to other countries, meaning smaller check sizes for early stage tech companies. So a private equity growth round like this represents a solid deal for tech-enabled businesses looking to gain market share of the world’s fifth most populous country.

Before the private equity round, QuintoAndar had raised $25 million. General Atlantic is fairly active in Latin America, with 18 portfolio companies based in the region, according to its website. “GA is one of the largest investors in online marketplaces across the globe combined with deep pockets, a long-term mindset, and a strong commitment and success within Latin America,” says the founder of the GA partnership.

Braga certainly believes Brazil is a large enough market to build a digital service for people who want to rent properties, but doesn’t want to stop there. The new capital will enable QuintoAndar to consolidate its already-existing operations in Belo Horizonte, Brasília and Goiânia, and start new operations in Porto Alegre and Curitiba. The investment will also be used to create a partnership system with the country’s main real-estate agencies who will be able to use the platform to offer QuintoAndar’s renting experience to clients, both landlords and tenants.

Investment into Latin American tech companies reached an all time high in 2017 thanks to mega rounds from US and Chinese investors – and the investment wave continued well in to 2018. Brazilian credit card processor Stone recently filed for an IPO on the Nasdaq. VCs continue pumping money into Latin America-based unicorns like Rappi and Nubank, and younger players are punching up against antiquated industries like banking and real estate.

QuintoAndar’s Series C brings the company’s total funding to $95 million (R$ 367,350,750). Braga declined to disclose the company’s valuation.

Much of the last couple of decades of innovation has centered around finding ways to get what we want without leaving the sofa.

So far, online ordering and on-demand delivery have allowed us to largely accomplish this goal. Just point, click and wait. But there’s one catch: Delivery people. We can never all lie around ordering pizzas if someone still has to deliver them.

Enter robots. In tech-futurist circles, it’s pretty commonplace to hear predictions about how some medley of autonomous vehicles and AI-enabled bots will take over doorstep deliveries in the coming years. They’ll bring us takeout, drop off our packages and displace lots of humans who currently make a living doing these things.

If this vision does become reality, there’s a strong chance it’ll largely be due to a handful of early-stage startups currently working to roboticize last-mile delivery. Below, we take a look at who they are, what they’re doing, who’s backing them and where they’re setting up shop.

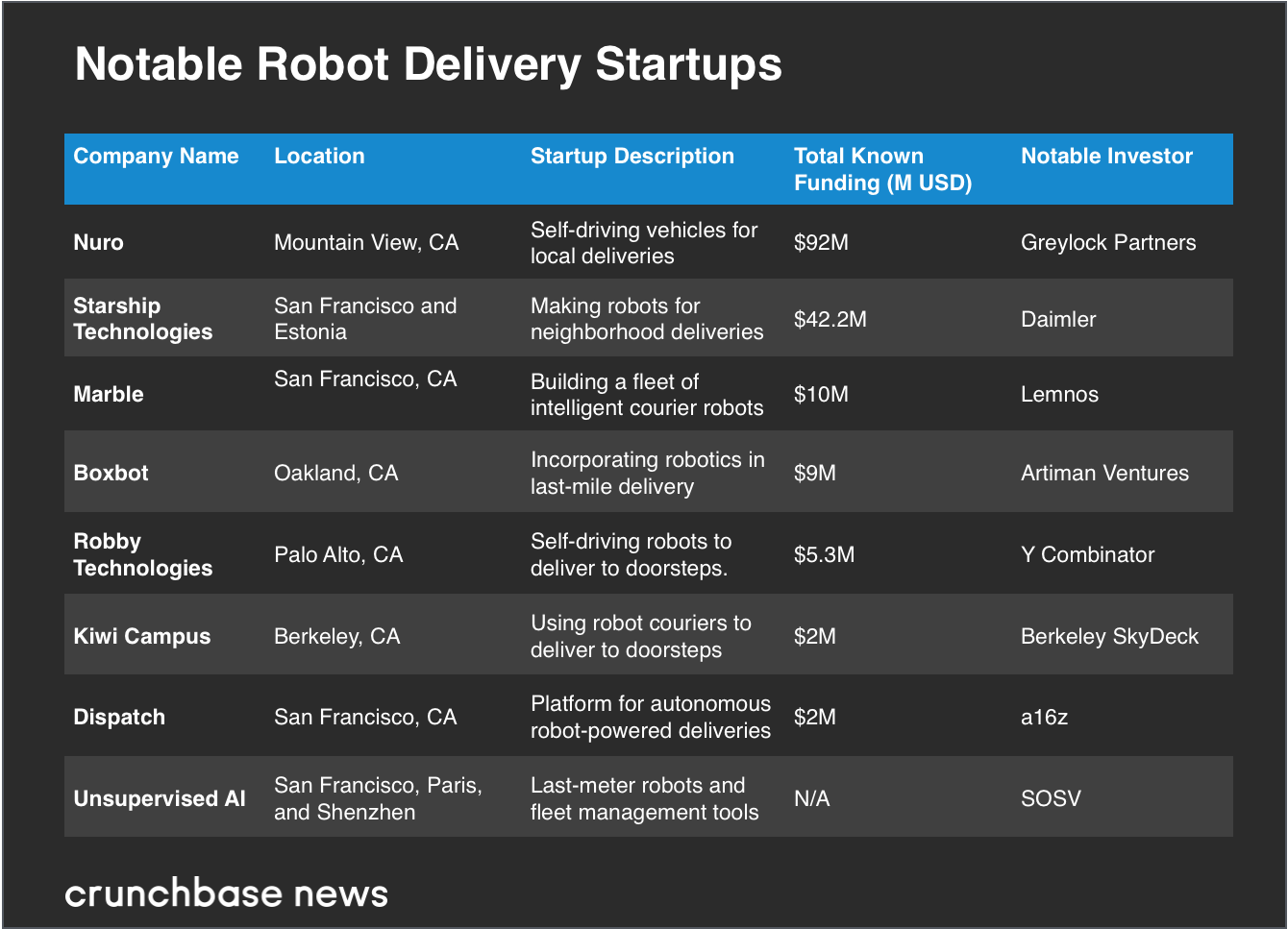

Crunchbase data unearthed at least eight companies in the robot delivery space with headquarters or operations in North America that have secured seed or early-stage funding in the past couple of years.

They range from heavily funded startups to lean seed-stage operations. Silicon Valley-based Nuro, an autonomous delivery startup founded by former engineers at Alphabet’s Waymo, is the most heavily funded, having raised $92 million to date. Others have raised a few million.

In the chart below, we look at key players, ranked by funding to date, along with their locations and key investors.

While startups may be paving the way for robot delivery, they’re not doing so alone. One of the ways larger enterprises are keeping a toehold in the space is through backing and partnering with early-stage startups. They’re joining a long list of prominent seed and venture investors also eagerly eyeing the sector.

The list of larger corporate investors includes Germany’s Daimler, the lead investor in Starship Technologies. China’s Tencent, meanwhile, is backing San Francisco-based Marble, while Toyota AI Ventures has invested in Boxbot.

As for partnering, takeout food delivery services seem to be the most active users of robot couriers.

Starship, whose bot has been described as a slow-moving, medium-sized cooler on six wheels, is making particularly strong inroads in takeout. The San Francisco- and Estonia-based company, launched by Skype founders Janus Friis and Ahti Heinla, is teaming up with DoorDash and Postmates in parts of California and Washington, DC. It’s also working with the Domino’s pizza chain in Germany and the Netherlands.

Robby Technologies, another maker of cute, six-wheeled bots, has also been partnering with Postmates in parts of Los Angeles. And Marble, which is branding its boxy bots as “your friendly neighborhood robot,” teamed up last year for a trial with Yelp in San Francisco.

While their visions of world domination are necessarily global, the robot delivery talent pool remains rather local.

Six of the eight seed- and early-stage startups tracked by Crunchbase are based in the San Francisco Bay Area, and the remaining two have some operations in the region.

Why is this? Partly, there’s a concentration of talent in the area, with key engineering staff coming from larger local companies like Uber, Tesla and Waymo. Plus, of course, there’s a ready supply of investor capital, which bot startups presumably will need as they scale.

Silicon Valley and San Francisco, known for scarce and astronomically expensive housing, are also geographies in which employers struggle to find people to deliver stuff at prevailing wages to the hordes of tech workers toiling at projects like designing robots to replace them.

That said, the region isn’t entirely friendly territory for slow-moving sidewalk robots. In San Francisco, already home to absurdly steep streets and sidewalks crowded with humans and discarded scooters, city legislators voted to ban delivery robots from most places and severely restrict them in areas where permitted.

But while San Francisco may be wary of a delivery robot invasion, other geographies, including nearby Berkeley, Calif., where startup Kiwi Campus operates, have been more welcoming.

In the process, they’re creating an interesting new set of robot overseer jobs that could shed some light on the future of last-mile delivery employment.

For some startups in early trial mode, robot wrangling jobs involve shadowing bots and making sure they carry out their assigned duties without travails.

Remote robot management is also a thing and will likely see the sharpest growth. Starship, for instance, relies on operators in Estonia to track and manage bots as they make their deliveries in faraway countries.

For now, it’s too early to tell whether monitoring and controlling hordes of delivery bots will provide better pay and working conditions than old-fashioned human delivery jobs.

At least, however, much of it could theoretically be done while lying on the sofa.

Chance Miller / 9to5Mac:

After Qualcomm and Apple fail to reach a settlement over patent royalties, judge schedules the start of the trial for April 15 in San Diego federal court — Earlier this week, Qualcomm CEO Steve Mollenkopf made headlines when he said his company was “on the doorstep of a resolution” with Apple, implying a settlement was possible.

Nick Summers / Engadget:

Profile of Chronicle: a startup incubated at Google X that uses AI and VirusTotal, with experience from Bigtable and MapReduce, to counter cybersecurity threats — Fifteen years ago, cybersecurity could be boiled down to a simple strategy: Secure the perimeter.

Watching Christmas movies on Netflix can be a great way to enjoy the holidays, especially if you want to immerse yourself in the season. And don’t worry about your connection, as there are many ways to improve your Netflix stream.

Whether or not you think Netflix is worth the money, Netflix is here to help you chill out and enjoy the holidays—no matter where you are in the world.

Netflix has a lot of content, and it can be difficult to sort the wheat from the chaff. To help you relax over the holidays, we’ve done the work for you and have selected several Christmas movies worth watching on Netflix.

How the Grinch Stole Christmas is a great movie for when you just want to sit back, relax with your family, and watch something that the kids can enjoy while staying within the Christmas spirit.

In this film, the Christmas-hating Grinch ruins the holiday for the inhabitants of Whoville, but when one thing leads to another, he learns that Christmas is about more than just shallow gifts and selfish consumerism. We all need such reminders every once in a while, don’t we?

Watch How the Grinch Stole Christmas on Netflix

Buy the How the Grinch Stole Christmas DVD or Blu-ray on Amazon

Bad Santa is a crime comedy film that follows a has-been department store Santa Claus who uses his position to break into safes and steals all of the money made during the weeks leading up to Christmas.

This isn’t a movie for everyone, what with its black comedy and dark moments. But if you’re looking for a Christmas movie that isn’t like the rest, then Bad Santa may be right up your street. That it stars the late Bernie Mac is just icing on the cake.

Watch Bad Santa on Netflix

Buy the Bad Santa DVD or Blu-ray on Amazon

A Very Murray Christmas features the one and only comedic genius that is Bill Murray, among a whole host of other Hollywood A-listers. The movie, pitched as a fake documentary, is hilarious and an “irreverent twist on holiday variety shows.”

The trailer should be all you need to know whether you’d like to check this one out for yourself. However, George Clooney is in it, so we’re guessing that’s half the population sold on it already.

Watch A Very Murray Christmas on Netflix

Love Actually is a Christmas classic that was once available on Netflix long ago, then taken off for some time, but now available again. If you haven’t seen it, you owe it to yourself to watch it at least once!

This ambitious film weaves together nine separate but connected stories, each exploring a different facet of Christmas love: parent and child, sibling and sibling, those who are single, those who are newlyweds, and more.

It’s packed with laughs and joy and feel-goodery, but that tenderness is balanced with bittersweet reality.

Watch Love Actually on Netflix

Buy the Love Actually DVD or Blu-ray on Amazon

Irving Berlin’s White Christmas movie is certainly a classic. The movie features Bing Crosby and Danny Kaye who start up a song-and-dance routine after the war and become wildly popular. The two then join a sister act, played by Rosemary Clooney and Vera Ellen, and head to Vermont to finally experience a White Christmas.

What makes this movie great, aside from the movie itself, are the nostalgic memories you may enjoy while watching it, as it has been regularly broadcast for many, many years during the holidays.

Watch White Christmas on Netflix

Buy the White Christmas DVD or Blu-ray on Amazon

Dear Santa is a straight-to-TV romantic drama movie starring Amy Acker and David Haydn-Jones. Yes, it’s a Lifetime channel movie, but don’t let that turn you away: Dear Santa is above average for what it is, and perfect for the holidays.

The story follows a well-off woman in her mid-30s who lives off of her parents money. But when one day she happens to read a letter addressed to Santa and written by a seven-year-old girl who recently lost her mother, she begins down a path that changes her life.

Watch Dear Santa on Netflix

Buy the Dear Santa DVD on Amazon

Get Santa is a British movie with British humor. The movie was released in 2014 and features a top notch group of actors and actresses, including Jim Broadbent, Kit Connor, Warwick Davis, and Rafe Spall.

What makes this movie eminently watchable is that it can be enjoyed by kids as well as adults. It also features an interesting plot that will really get the kids in the family cheering for Santa. As if they weren’t doing so already.

Watch Get Santa on Netflix

Buy the Get Santa DVD or Blu-ray on Amazon

Tired of the usual Christmas cliches? Then you’re in for a treat. While The Spirit of Christmas has its flaws, you’ll be able to overlook them for its unique spin on what a Christmas film can be.

Follow the hard-working lawyer, Kate, as she attempts to appraise and sell an old bed and breakfast before the year ends, only to find that it’s “haunted” by a cursed spirit. Figuring out how he died could be the key that unlocks the secrets of his curse.

Yes, there’s a romance subplot, but it’s mixed in with an interesting mystery—not of the thriller variety, just straight up drama.

Watch The Spirit of Christmas on Netflix

Buy the Spirit of Christmas DVD on Amazon

Christmas is a time for family, but family meetups aren’t always something to look forward to—especially if your family tends to hound you about your life choices and singlehood.

In Holiday Engagement, Hillary hires an actor to pose as her fiance as she returns home for Thanksgiving and Christmas.

It’s an unoriginal premise we’ve all seen plenty of times before, sure, but the execution here is better than you’d expect. At the end of the day, it’s a fun little romantic comedy with some holiday cheer. Isn’t that all that matters?

Watch Holiday Engagement on Netflix

Buy the Holiday Engagement DVD on Amazon

A Christmas Prince is the perfect movie to watch if you’re feeling down, want to shut off your brain, and sink into a sappy movie with a tub of ice cream by your side.

When a young journalist travels across the pond and goes undercover to report on a prince who’s turning king, she gets tangled up in more than she expected. It’s silly, it’s bright, it’s uplifting—all the right emotions for the most wonderful time of the year.

Watch A Christmas Prince on Netflix

If you’re looking for more great Christmas movies to watch on Netflix, see our article on how to find Netflix movies you’ll love. Want to watch these movies with someone who’s in another city or country? See our article on how to watch Netflix with friends who are far away.

Not keen on paying for Netflix? You may be able to find more Christmas movies to watch using one of these excellent free movie streaming websites.

Read the full article: The 10 Best Christmas Movies on Netflix to Watch This Year

In order to have innovative smart city applications, cities first need to build out the connected infrastructure, which can be a costly, lengthy, and politicized process. Third-parties are helping build infrastructure at no cost to cities by paying for projects entirely through advertising placements on the new equipment. I try to dig into the economics of ad-funded smart city projects to better understand what types of infrastructure can be built under an ad-funded model, the benefits the strategy provides to cities, and the non-obvious costs cities have to consider.

Consider this an ongoing discussion about Urban Tech, its intersection with regulation, issues of public service, and other complexities that people have full PHDs on. I’m just a bitter, born-and-bred New Yorker trying to figure out why I’ve been stuck in between subway stops for the last 15 minutes, so please reach out with your take on any of these thoughts: @Arman.Tabatabai@techcrunch.com.

When we talk about “Smart Cities”, we tend to focus on these long-term utopian visions of perfectly clean, efficient, IoT-connected cities that adjust to our environment, our movements, and our every desire. Anyone who spent hours waiting for transit the last time the weather turned south can tell you that we’ve got a long way to go.

But before cities can have the snazzy applications that do things like adjust infrastructure based on real-time conditions, cities first need to build out the platform and technology-base that applications can be built on, as McKinsey’s Global Institute explained in an in-depth report released earlier this summer. This means building out the network of sensors, connected devices and infrastructure needed to track city data.

However, reaching the technological base needed for data gathering and smart communication means building out hard physical infrastructure, which can cost cities a ton and can take forever when dealing with politics and government processes.

Many cities are also dealing with well-documented infrastructure crises. And with limited budgets, local governments need to spend public funds on important things like roads, schools, healthcare and nonsensical sports stadiums which are pretty much never profitable for cities (I’m a huge fan of baseball but I’m not a fan of how we fund stadiums here in the states).

As city infrastructure has become increasingly tech-enabled and digitized, an interesting financing solution has opened up in which smart city infrastructure projects are built by third-parties at no cost to the city and are instead paid for entirely through digital advertising placed on the new infrastructure.

I know – the idea of a city built on ad-revenue brings back soul-sucking Orwellian images of corporate overlords and logo-paved streets straight out of Blade Runner or Wall-E. Luckily for us, based on our discussions with developers of ad-funded smart city projects, it seems clear that the economics of an ad-funded model only really work for certain types of hard infrastructure with specific attributes – meaning we may be spared from fire hydrants brought to us by Mountain Dew.

While many factors influence the viability of a project, smart infrastructure projects seem to need two attributes in particular for an ad-funded model to make sense. First, the infrastructure has to be something that citizens will engage – and engage a lot – with. You can’t throw a screen onto any object and expect that people will interact with it for more than 3 seconds or that brands will be willing to pay to throw their taglines on it. The infrastructure has to support effective advertising.

Second, the investment has to be cost-effective, meaning the infrastructure can only cost so much. A third-party that’s willing to build the infrastructure has to believe they have a realistic chance of generating enough ad-revenue to cover the costs of the projects, and likely an amount above that which could lead to a reasonable return. For example, it seems unlikely you’d find someone willing to build a new bridge, front all the costs, and try to fund it through ad-revenue.

A LinkNYC kiosk enabling access to the internet in New York on Saturday, February 20, 2016. Over 7500 kiosks are to be installed replacing stand alone pay phone kiosks providing free wi-fi, internet access via a touch screen, phone charging and free phone calls. The system is to be supported by advertising running on the sides of the kiosks. ( Richard B. Levine) (Photo by Richard Levine/Corbis via Getty Images)

To get a better understanding of the types of smart city hardware that might actually make sense for an ad-funded model, we can look at the engagement levels and cost structures of smart kiosks, and in particular, the LinkNYC project. Smart kiosks – which provide free WiFi, connectivity and real-time services to citizens – have been leading examples of ad-funded smart city projects. Innovative companies like Intersection (developers of the LinkNYC project), SmartLink, IKE, Soofa, and others have been helping cities build out kiosk networks at little-to-no cost to local governments.

LinkNYC provides public access to much of its data on the New York City Open-Data website. Using some back-of-the-envelope math and a hefty number of assumptions, we can try to get to a very rough range of where cost and engagement metrics generally have to fall for an ad-funded model to make sense.

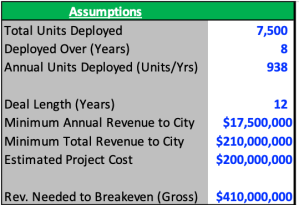

To try and retrace considerations for the developers’ investment decision, let’s first look at the terms of the deal signed with New York back in 2014. The agreement called for a 12-year franchise period, during which at least 7,500 Link kiosks would be deployed across the city in the first eight years at an expected project cost of more than $200 million. As part of its solicitation, the city also required the developers to pay the greater of either a minimum annual payment of at least $17.5 million or 50 percent of gross revenues.

Let’s start with the cost side – based on an estimated project cost of around $200 million for at least 7,500 Links, we can get to an estimated cost per unit of $25,000 – $30,000. It’s important to note that this only accounts for the install costs, as we don’t have data around the other cost buckets that the developers would also be on the hook for, such as maintenance, utility and financing costs.

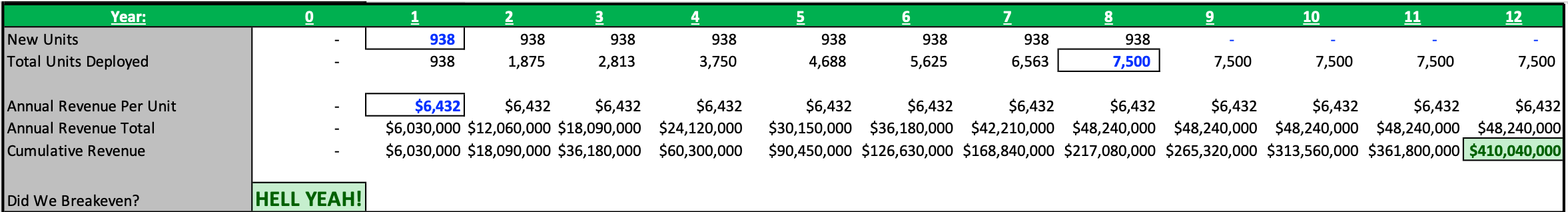

Source: LinkNYC, NYC.gov, NYCOpenData

Turning to engagement and ad-revenue – let’s assume that the developers signed the deal with the expectations that they could at least breakeven – covering the install costs of the project and minimum payments to the city. And for simplicity, let’s assume that the 7,500 links were going to be deployed at a steady pace of 937-938 units per year (though in actuality the install cadence has been different). In order for the project to breakeven over the 12-year deal period, developers would have to believe each kiosk could generate around $6,400 in annual ad-revenue (undiscounted).

Source: LinkNYC, NYC.gov, NYCOpenData

The reason the kiosks can generate this revenue (and in reality a lot more) is because they have significant engagement from users. There are currently around 1,750 Links currently deployed across New York. As of November 18th, LinkNYC had over 720,000 weekly subscribers or around 410 weekly subscribers per Link. The kiosks also saw an average of 18 million sessions per week, or 20-25 weekly sessions per subscriber, or around 10,200 weekly sessions per kiosk (seasonality might even make this estimate too low).

And when citizens do use the kiosks, they use it for a long time! The average session for each Link unit was four minutes and six seconds. The level of engagement makes sense since city-dwellers use these kiosks in time or attention-intensive ways, such making phone calls, getting directions, finding information about the city, or charging their phones.

The analysis here isn’t perfect, but now we at least have a (very) rough idea of how much smart kiosks cost, how much engagement they see, and the amount of ad-revenue developers would have to believe they could realize at each unit in order to ultimately move forward with deployment. We can use these metrics to help identify what types of infrastructure have similar profiles and where an ad-funded project may make sense.

Bus stations, for example, may cost about $10,000 – $15,000, which is in a similar cost range as smart kiosks. According to the MTA, the NYC bus system sees over 11.2 million riders per week or nearly 700 riders per station per week. Rider wait times can often be five-to-ten minutes in length if not longer. Not to mention bus stations already have experience utilizing advertising to a certain degree. Projects like bike-share docking stations and EV charging stations also seem to fit similar cost profiles while having high engagement.

And interactions with these types of infrastructure are ones where users may be more receptive to ads, such as an EV charging station where someone is both physically engaging with the equipment and idly looking to kill up sometimes up to 30 minutes of time as they charge up. As a result, more companies are using advertising models to fund projects that fit this mold, like Volta, who uses advertising to offer charging stations free to citizens.

When it makes sense for cities and third-party developers, advertising-funded smart city infrastructure projects can unlock a tremendous amount of value for a city. The benefits are clear – cities pay nothing, citizens are offered free connectivity and real-time information on local conditions, and smart infrastructure is built and can possibly be used for other smart city applications down the road, such as using locational data tracking to improve city zoning and congestion.

Yes, ads are usually annoying – but maybe understanding that advertising models only work for specific types of smart city projects may help quell fears that future cities will be covered inch-to-inch in mascots. And ads on projects like LinkNYC promote local businesses and can tap into idiosyncratic conditions and preferences of regional communities – LinkNYC previously used real-time local transit data to display beer ads to subway riders that were facing heavy delays and were probably in need of a drink.

Like everyone’s family photos from Thanksgiving, the picture here is not all roses, however, and there are a lot of deep-rooted issues that exist under the surface. Third-party developed, advertising-funded infrastructure comes with externalities and less obvious costs that have been fairly criticized and debated at length.

When infrastructure funding is derived from advertising, concerns arise over whether services will be provided equitably across communities. Many fear that low-income or less-trafficked communities that generate less advertising demand could end up having poor infrastructure and maintenance.

Even bigger points of contention as of late have been issues around data consent and treatment. I won’t go into much detail on the issue since it’s incredibly complex and warrants its own lengthy dissertation (and many have already been written).

But some of the major uncertainties and questions cities are trying to answer include: If third-parties pay for, manage and operate smart city projects, who should own data on citizens’ living behavior? How will citizens give consent to provide data when tracking systems are built into the environment around them? How can the data be used? How granular can the data get? How can we assure citizens’ information is secure, especially given the spotty track records some of the major backers of smart city projects have when it comes to keeping our data safe?

The issue of data treatment is one that no one has really figured out yet and many developers are doing their best to work with cities and users to find a reasonable solution. For example, LinkNYC is currently limited by the city in the types of data they can collect. Outside of email addresses, LinkNYC doesn’t ask for or collect personal information and doesn’t sell or share personal data without a court order. The project owners also make much of its collected data publicly accessible online and through annually published transparency reports. As Intersection has deployed similar smart kiosks across new cities, the company has been willing to work through slower launches and pilot programs to create more comfortable policies for local governments.

But consequential decisions related to third-party owned smart infrastructure are only going to become more frequent as cities become increasingly digitized and connected. By having third-parties pay for projects through advertising revenue or otherwise, city budgets can be focused on other vital public services while still building the efficient, adaptive and innovative infrastructure that can help solve some of the largest problems facing civil society. But if that means giving up full control of city infrastructure and information, cities and citizens have to consider whether the benefits are worth the tradeoffs that could come with them. There is a clear price to pay here, even when someone else is footing the bill.

Sirius XM’s recent all-stock $3.5-billion purchase of the music-streaming service Pandora raised a lot of eyebrows. A big question was why Sirius paid so much. Is Pandora’s music library and customer base really worth that amount? The answer is that this was a strategic move by Sirius in a battle that is far bigger than radio. The real battle, which will become much more visible in the coming years, is over the driving experience.

People spend a lot of time commuting in their cars. That time is fixed and won’t likely change. However, what is changing is the way we drive. We’re already seeing many new cars with driver assist features, and automakers (and tech companies) are working hard to bring fully autonomous cars to the market as quickly as possible. New cars today already contain an average of 100 million lines of code that can be updated to increase driver assist options, and some automakers like Tessla already offer an “autonomous” mode on highways.

According to the Brookings Institute, one-quarter of all cars will be autonomous by 2040 and IHS predicts all cars will be autonomous after 2050. Those are conservative estimates, as we are likely to see major changes in the next 10 years.

These changes will impact the driving experience. As cars become more autonomous, we can do more than simply listen to music or podcasts. We may be able to watch videos, surf the web, and more. The value of car real estate is already valuable, but it’s going to skyrocket as we change the way people consume media while driving.

The Pandora acquisition was a strategic move by Sirius to gain the necessary assets so that it won’t fall behind in this space — and to get into the fast-growing music streaming business, where users consume music at home, work and at play. While Pandora’s music library is arguably second tier, it’s also good enough that it can provide pretty much every artist most people want. This is often how high-priced mergers happen – one party is concerned about falling behind and pays a premium to purchase the other company’s assets. It’s also a bet by Sirius about the driving experience of the future.

As the battle over the driving experience heats up, we will initially see companies like Google, Amazon and Apple start dipping their toes in the market. They might do that through investments in startups, rolling out their own services, or purchasing competitors. Some of those large tech companies already have projects around autonomous cars. Uber may even be interested in this market.

For now, Sirius probably doesn’t need to worry about competition from startups. They won’t be able to grow big enough fast enough to get a sizable share of the market. A more likely scenario is that startups will work on software that offers a unique functionality, making it an attractive acquisition target by a larger company.

This is going to be an interesting battle to watch in the coming years, as cars essentially become software with four wheels attached. Companies like Sirius know this is an important space and that the battle over the driving experience will be won in software. The acquisition of Pandora is only the beginning.