Lagos based online lending startup OneFi is buying Nigerian payment solutions company Amplify for an undisclosed amount.

OneFi will take over Amplify’s IP, team, and client network of over 1000 merchants to which Amplify provides payment processing services, OneFi CEO Chijioke Dozie told TechCrunch.

The move comes as fintech has become one of Africa’s most active investment sectors and startup acquisitions—which have been rare—are picking up across the continent.

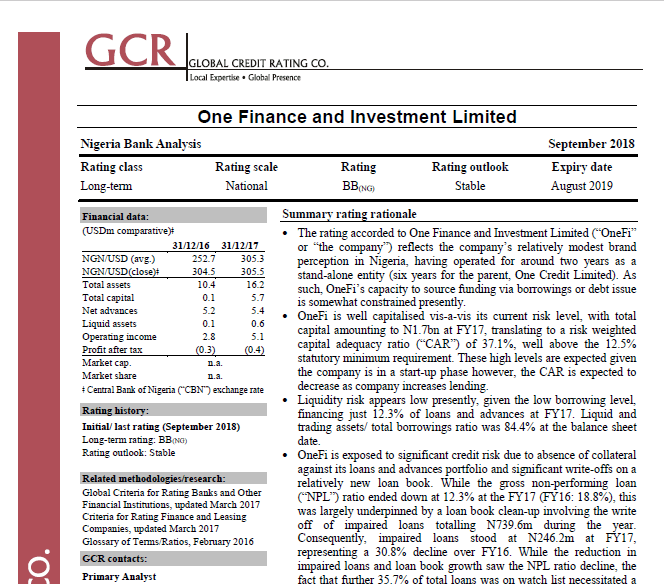

The purchase of Amplify caps off a busy period for OneFi. Over the last seven months the Nigerian venture secured a $5 million lending facility from Lendable, announced a payment partnership with Visa, and became one of first (known) African startups to receive a global credit rating. OneFi is also dropping the name of its signature product, Paylater, and will simply go by OneFi (for now).

Collectively, these moves represent a pivot for OneFi away from operating primarily as a digital lender, toward becoming an online consumer finance platform.

“We’re not a bank but we’re offering more banking services…Customers are now coming to us not just for loans but for cheaper funds transfer, more convenient bill payment, and to know their credit scores,” said Dozie.

OneFi will add payment options for clients on social media apps including WhatsApp this quarter—something in which Amplify already holds a specialization and client base. Through its Visa partnership, OneFi will also offer clients virtual Visa wallets on mobile phones and start providing QR code payment options at supermarkets, on public transit, and across other POS points in Nigeria.

Founded in 2016 by Segun Adeyemi and Maxwell Obi, Amplify secured its first seed investment the same year from Pan-African incubator MEST Africa. The startup went on to scale as a payments gateway company for merchants and has partnered with banks, who offer its white label mTransfers social payment product.

Amplify has differentiated itself from Nigerian competitors Paystack and Flutterwave, by committing to payments on social media platforms, according to OneFi CEO Dozie. “We liked that and thought payments on social was something we wanted to offer to our customers,” he said.

With the acquisition, Amplify co-founder Maxwell Obi and the Amplify team will stay on under OneFi. Co-founder Segun Adeyemi won’t, however, and told TechCrunch he’s taking a break and will “likely start another company.”

OneFi’s purchase of Amplify adds to the tally of exits and acquisitions in African tech, which are less common than in other regional startup scenes. TechCrunch has covered several of recent, including Nigerian data-analytics company Terragon’s buy of Asian mobile ad firm Bizsense and Kenyan connectivity startup BRCK’s recent purchase of ISP Everylayer and its Nairobi subsidiary Surf.

These acquisition events, including OneFi’s purchase, bump up performance metrics around African tech startups. Though amounts aren’t undisclosed, the Amplify buy creates exits for MEST, Amplify’s founders, and its other investors. “I believe all the stakeholders, including MEST, are comfortable with the deal. Exits aren’t that commonplace in Africa, so this one feels like a standout moment for all involved,”

With the Amplify acquisition and pivot to broad-based online banking services in Nigeria, OneFi sets itself up to maneuver competitively across Africa’s massive fintech space—which has become infinitely more complex (and crowded) since the rise of Kenya’s M-Pesa mobile money product.

![]()

By a number of estimates, the continent’s 1.2 billion people include the largest share of the world’s unbanked and underbanked population. An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns that problem into an opportunity for mobile based financial solutions. Hundreds of startups are descending on this space, looking to offer scaleable solutions for the continent’s financial needs. By stats offered by Briter Bridges and a 2018 WeeTracker survey, fintech now receives the bulk of VC capital to African startups,

OneFi is looking to expand in Africa’s fintech markets and is considering Senegal, Côte d’Ivoire, DRC, Ghana and Egypt and Europe for Diaspora markets, Dozie said.

The startup is currently fundraising and looks to close a round by the second half of 2019. OnfeFi’s transparency with performance and financials through its credit rating is supporting that, according to Dozie.

There’s been sparse official or audited financial information to review from African startups—with the exception of e-commerce unicorn Jumia, whose numbers were previewed when lead investor Rocket Internet went public and in Jumia’s recent S-1, IPO filing (covered here).

OneFi gained a BB Stable rating from Global Credit Rating Co. and showed positive operating income before taxes of $5.1 million in 2017, according to GCR’s report. Though the startup is still a private company, OneFi looks to issue a 2018 financial report in the second half of 2019, according to Dozie.

from TechCrunch https://ift.tt/2TmExB9

No comments:

Post a Comment