Volopay founders Rajith Shaji and Rajesh Raikwar

Small- to medium-sized companies that do a lot of international business have to deal with two big headaches: high foreign exchange fees and corporate expense tracking. Volopay, a Singapore-based financial tech startup with offices in Bangalore, wants to help by integrating prepaid multi-currency corporate cards, expense tracking and accounting tools into one free-to-use platform.

Volopay is currently taking part in Y Combinator and is also part of Antler and Nium’s Bolt, two other accelerator programs. It now has about 40 clients in Singapore, mostly tech startups like Dathena, Tookitaki and Appknox, and plans to launch in Indonesia and Australia within the next six months.

The company was founded last year by chief executive officer Rajith Shaji and chief technology officer Rajesh Raikwar, who met while working at MoneySmart, a financial services comparison platform. Before joining MoneySmart, Shaji also held positions at fintech companies like CompareAsiaGroup, MatchMove and BankBazaar.com.

Shaji spent most of his time working in India, but often traveled to offices abroad. Dealing with corporate expenses after every trip was a “nightmare,” Shaji told TechCrunch.

“Each time I went back home, I had to make a list of all my expenses on behalf of the company. First of all, it often ran up to a few thousand dollars and I had to put in all these receipts and everything,” he said.

Shaji did not have access to most of the accounting software used by the companies’ accounting departments and communicating with them across different time zones made the process even more cumbersome and time-consuming.

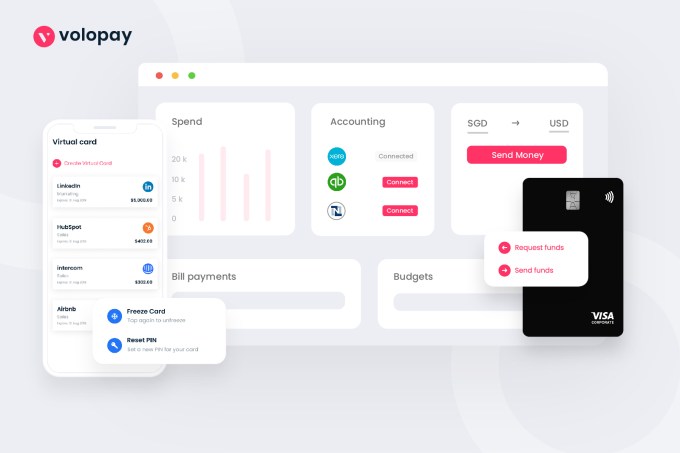

Volopay addresses those issues by combining prepaid multi-currency corporate cards (available as physical or virtual cards), domestic and international bank transfers, automated payments, and expense and accounting software on one platform. Volopay’s app lets employees ask for more funds for their prepaid cards from managers, who can approve or reject the request instantly.

Shaji said this saves companies money on foreign exchange fees, which are typically about 3% of a transaction on a traditional credit card, and gives them real-time visibility into spending.

Volopay is free to use and earns money through the interchange fees credit cards charge merchants. Interchange fees also enable Volopay to offer perks like cashback deals.

Shaji said the company aspires to be the “Brex of Southeast Asia.” Like Brex, it offers an alternative to traditional financial services for startups and other small- to mid-sized businesses. But it needs to compete with several companies that also want to solve some of the same problems, like high fees for cross-border banking and corporate expense tracking. For example, Transferwise and Revolut both have operations in Singapore, while Neat and Aspire, based in Hong Kong and Singapore respectively, offer online business accounts.

Shaji said Volopay’s integration of multiple services on one platform gives it a competitive edge, adding that a better comparison to his startup is YouTrip, a multi-currency wallet for consumers that is popular in Singapore.

With accounts linked to a prepaid Mastercard, YouTrip users can make payments in 150 currencies without fees and it also supports in-app foreign currency exchanges. When explaining Volopay to potential clients, Shaji often refers to it as “YouTrip for companies.”

“YouTrip is a well-known brand [in Singapore], everyone knows they can load their money on it and save money on foreign exchange,” he said. Volopay gives the same functionality to companies, with accounting software added.

Volopay currently focuses on serving small businesses with 25 or more employees, especially tech startups that are scaling their operations and therefore need to manage increasing numbers of online payments and expenses. Shaji said Volopay has also signed up several marketing agencies, because many work on multiple projects, and therefore have to juggle multiple budgets at once.

from TechCrunch https://ift.tt/39EgS8Y

No comments:

Post a Comment