Two-year-old CRED has become the youngest Indian startup to be valued at $2 billion or higher.

Bangalore-based CRED said on Tuesday it has raised $215 million in a new funding round — a Series D — that valued the Indian startup at $2.2 billion (post-money), up from about $800 million valuation in $81 million Series C round in January this year.

New investor Falcon Edge Capital and existing investor Coatue Management led the new round. Insight Partners and existing investors DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group, and Sofina also participated in the new round, which brings CRED’s total to-date raise to about $443 million.

TechCrunch reported last month that CRED was in advanced stages of talks to raise about $200 million at a valuation of around $2 billion.

CRED operates an app that rewards customers for paying their credit card bills on time and gives them access to a range of additional services such as credit and a premium catalog of products from high-end brands.

An individual needs to have a credit score of at least 750 to be able to sign up for CRED. By keeping such a high bar, the startup says it is ensuring that people are incentivized to improve their financial behavior. (More on this later.)

CRED today serves more than 6 million customers, or about 22% of all credit card holders — and 35% of all premium credit card holders — in the world’s second largest internet market.

Kunal Shah, founder and chief executive of CRED, told TechCrunch in an interview that the startup intends to become the platform for affluent customers in India and also not limit its offerings to financial services.

He said the startup’s e-commerce service, for instance, has been growing fast. He attributed the early success to customers enjoying the curation of items on CRED and merchants finding the platform appealing as ticket size of each transaction on CRED is higher.

The startup plans to deploy the fresh funds to scale several of its revenue channels and engage in more experimentations, he said.

When asked whether CRED would like to serve all credit card users in India some day, Shah said the selection criteria limits the startup from doing so, but he said he was optimistic that more users will improve their scores in the future.

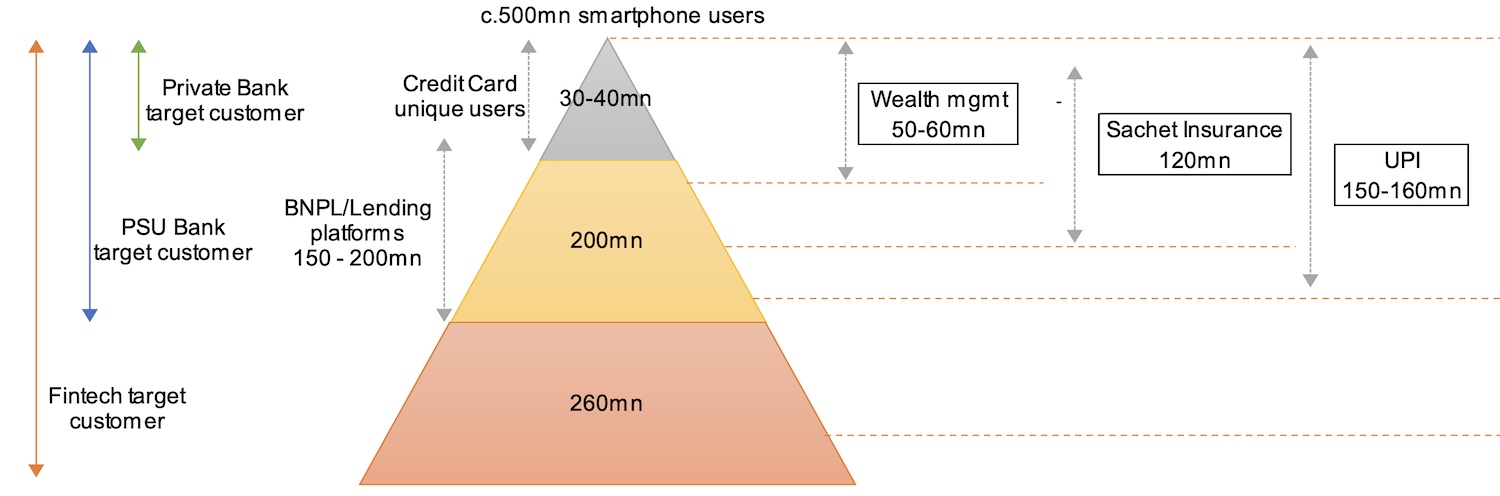

The startup, unlike most others in India, doesn’t focus on the usual TAM (addressable market) — hundreds of millions of users of the world’s second-most populated nation — and instead caters to some of the most premium audiences.

Consumer segmentation and addressable market for fintech firms in India (BofA Research)

“India has 57 million credit cards (vs 830 million debit cards) [that] largely serves the high-end market. The credit card industry is largely concentrated with the top 4 banks (HDFC, SBI, ICICI and Axis) controlling about 70% of the total market. This space is extremely profitable for these banks – as evident from the SBI Cards IPO,” analysts at Bank of America wrote in a recent report to clients.

“Very few starts-ups like CRED are focusing on this high-end base and [have] taken a platform-based approach (acquire customers now and look for monetization later). Credit card in India remains an aspirational product. The under penetration would likely ensure continued strong growth in coming years. Overtime, the form-factor may evolve (i.e. move from plastic card to virtual card), but the inherent demand for credit is expected to grow,” they added.

CRED has become one of the most talked about startups in India, in part because of the pace at which it has raised money of late, its growing valuation, and the fact that it only caters to select customers.

Some users have also said that CRED no longer offers them the perks it used a year ago.

Shah said CRED is addressing those concerns. A recent feature, which allows customers to use CRED points at over a thousand merchants, for instance, has made the reward more appealing, he said, adding that the startup is slowly incorporating that into its own e-commerce store as well.

“What will soon happen is that customers will realize that these points are asset and not a liability. They will start to see benefits of the points in more places,” he said, adding that the pandemic derailed some of the things CRED had planned for in the real world.

This is a developing story. More to follow…

from TechCrunch https://ift.tt/3wysqFG

No comments:

Post a Comment