Robinhood is undercutting the big banks by forgoing brick-and-mortar branches with its new zero-fee checking and savings account features. With no overdraft or monthly fees, a juicy 3 percent interest rate, and a claim of more US ATMs than the five biggest banks combined, Robinhood is using the scalability of software to pass impressive perks on to customers. The free stock trading app already used that approach to attack brokers like E*Trade and Charles Schwab that charge a per trade fee. Now it’s breaking into the larger financial services market with a model that could put the squeeze on Wells Fargo, Chase, and Bank Of America.

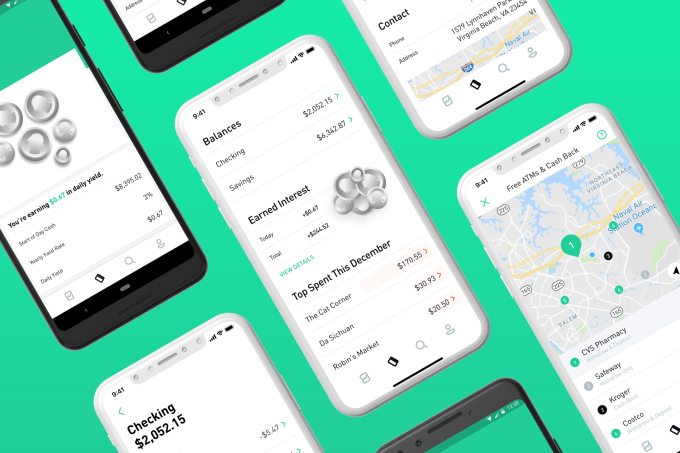

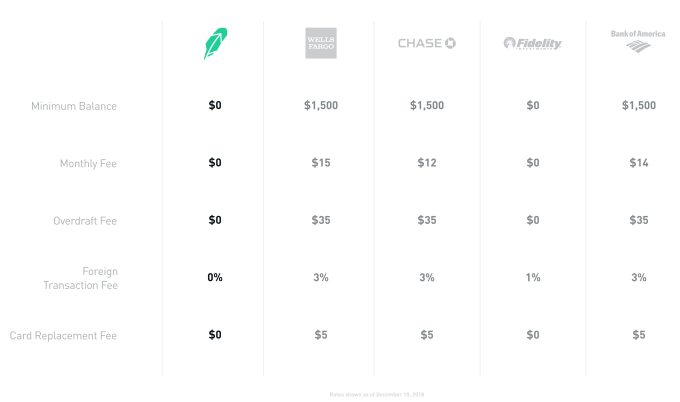

Today Robinhood launches checking and savings accounts in the US with a Mastercard debit card issued through Sutton Bank that starts shipping December 18th. Users earn 3 percent on all the dough they keep with Robinhood, yet there’s no minimum balance or fees for monthly membership, overdrafts, foreign transactions, or card replacements. That’s a pretty sweet deal compared to the other leading banks that all charge for some of that or offer much lower interest rates. The tradeoff is that while customers get 24/7 live text chat support, they won’t be able to walk into a local bank branch.

Robinhood expects to turn a profit thanks to a lean 300-employee operation, earning a margin on investing your money in US treasuries, and a revenue share with Mastercard on interchange fees charged to merchants when you swipe. The launch could be critical to keeping Robinhood worthy of its $5.6 billion valuation from when it took a $363 million Series D in March just a year after raising at a $1.3 billion valuation. The 6 million-user app invested in launching a free cryptocurrency trading exchange early this year only to see coin prices plummet and mainstream interest fall off. But with banks hammering users with surprise fees and mediocre user experience, there’s a huge opportunity for a mobile-first startup to disrupt how we store money.

“Brick-and-mortar locations are costly. Our goal with this product was to build a completely digital experience so we can reduce our overhead so we can pass more of the value back to customers” Robinhood co-CEO Baiju Bhatt tells me. “Saving accounts in the US pay on average 0.09 percent and we all know the banks are making far more than that from the deposits. With Robinhood you earn 3 percent off all of your money. Mental math is hard so if you look at the median US household that has about $8000 in liquid savings, they’d earn $240 a year.”

Getting into banking could open a lucrative revenue stream for Robinhood as it charts its path to IPO. The startup recently hired Jason Warnick, a 20-year veteran of Amazon, to be its CFO and get it prepped to go public. Wall Street will want to see a more robust business that’s not as vulnerable to foes like stock brokerage Charles Schwab which is already lowering fees to stay competitive with Robinhood. Not only will checking and savings see users move more money into their Robinhood accounts that it can invest to earn a profit, but it also poises the startup to tackle more financial services in the future.

from TechCrunch https://ift.tt/2Gf21qy

No comments:

Post a Comment