For all of the excitement centered around fintech over the past half-decade, most venture-backed fintech companies struggle to acclimate to public markets. LendingClub and OnDeck have plummeted since their late 2014 IPOs after several years of darling status in the private markets. GreenSky, which went public in May of this year, has been unable to return to its IPO price. Square is the exception to the rule.

Sometimes we overlook the companies that hail from the era that precedes the current wave of fintech fascination, a vertical which has accumulated over $100 billion in global investment capital since 2010.

One of these companies is LendingTree, which got its start height of the Internet bubble, going public in mid-February of 2000, less than a month before the Dot-com bubble peaked. LendingTree began in 1996 in a founding story that epitomizes the early Internet era. Doug Lebda, an accountant searching for homes in Pittsburgh, had to manually compare mortgage offers from each bank. So he created a marketplace for loans in the same way OpenTable helps you find your restaurant of choice or Zillow simplifies the home buying process. In the words of Rich Barton, iconic founder of Expedia, Zillow, and Glassdoor, this business is a classic “power to the people play.”

The marketplace business model has been the darling that has driven returns for many of the leading VCs like Benchmark, a16z, and Greylock. Network effects are a non-negotiable part of the explanation as to why. Classic success stories that have transitioned nicely into public markets include Zillow, OpenTable (acq.), Etsy, Booking.com, and Grubhub. LendingTree is often left off of this list, yet, the business sits in a compelling space as consumers and lenders continue to manage their financial lives online.

Insight in a Sea of Ambiguity

The lending process has been defined by significant information asymmetry between borrowers and lenders. Lenders have a disproportionate amount of leverage in the relationship. And that’s not to say it should be different – it’s perfectly logical to require a borrower to prove their creditworthiness. However, aggregation, synthesis, and recommendations modernize a dated dynamic.

Ironically, in an age where consumers are inundated with information, less than 50% of interested borrower’s shop for loans. Most consumers take the first offer they receive. The benefit of a marketplace, however, is price competition and transparency. The ability to shop the market and access the same information that lenders have is a luxury that didn’t exist twenty years ago. The borrowers who do shop through LendingTree reap significant benefits; on average, roughly $14,000 on mortgages and 570 basis points on personal loans. There’s certainly something to be said for comfortability and hand-holding, but at some point the metrics speak for themselves.

LendingTree isn’t a marketplace in the purest sense because of the process that takes place after a borrower clicks “apply.” While a diner can reserve a table at any listed restaurant with OpenTable for dinner tomorrow tonight, she can’t simply take the loan she wants. LendingTree lacks the direct feedback loop between consumers and lenders that characterizes most marketplaces. Instead, the platform aggregates information from a network of over 500 lenders to provide options according consumer’s needs. LendingTree is effectively the onramp for interested borrowers, which necessitates the entry of lenders to fill the borrower’s needs.

As this “onramp” continues to serve a larger audience as more consumers conduct their finances online, banks and lenders intend to seize the opportunity. Digital ad spend in the financial services industry is going to continue to grow rapidly at an estimated 20% CAGR between 2014 and 2020, effectively tripling the size of LendingTree’s core market.

Diversifying away from Mortgages

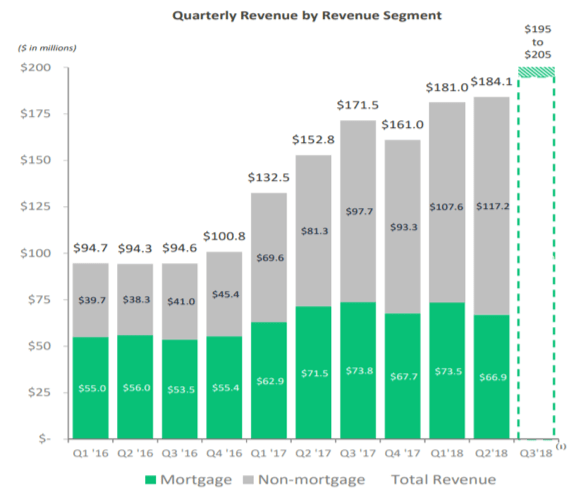

LendingTree’s revenue mix has change over the years.

For all intents and purposes, LendingTree has been in the mortgage business since its inception. The company experimented with a myriad of business models, including a foray into loan origination through their LendingTree Loans product line, which they ultimately sold off to Discover in 2011. Even in 2013, only 11% of their revenue originated from non-mortgage products.

LendingTree has expanded their platform in a few short years to build their non-mortgage products including credit cards, HELOCs, personal, auto, and small business loans. They have also pursued credit repair services and deposit accounts, with insurance in the pipeline. Whereas mortgage revenue made up roughly 60% of total sales in Q2 2016, it dropped to 36% as of this quarter. They wanted to diversify their product mix, but they realized they were also leaving money on the table.

Through strategic M&A activity, LendingTree has acquired a number of leading media and comparison properties to expand into new products. Acquiring CompareCards, a leading online source for credit card comparisons, has allowed them to catch up to Credit Karma and Bankrate, who own a large part of the existing market. Additional acquisitions in tertiary products like student loans, deposit accounts, and credit services have enabled the company to expand their market share in markets that are both ripe for growth and sparse of competition. The inorganic growth strategy emulates that of two of LendingTree’s major shareholders: Barry Diller, who’s company IAC previously owned LendingTree before spinning them off in 2008, and John Malone, who owned 27% of shares as of November, 2017.

LendingTree has made significant acquisitions to expand and grow

Enhancing Customer Engagement

The potential scale and success of LendingTree’s business model is predicated on discovering prospective borrowers. If they’re repeat customers, that’s a big win because their promotional costs drop significantly once a customer is familiar with the platform.

My LendingTree, the company’s personal financial management (PFM) app launched in 2014, has 8.8 million customers and generates roughly 20% of the company’s leads. It offers free credit scores, credit monitoring, and goals-based guidance through a proprietary credit and debt analyzer. At the surface, it’s not especially different from any of the other leading consumer PFM apps. That’s been the issue with these apps: the service is valuable, but it’s very difficult to differentiate beyond UI/UX, which is far from a defensible moat.

However, the ability for LendingTree to lock in customers and accumulate customer data to personalize product recommendations is a breakthrough for both consumers and lenders. Consumers outsource the loan diligence process to their phone, which explores the universe of lending options in order to find the most suitable options.

LendingTree’s new personal finance management app. (Photo by LendingTree)

The leader in this space is Credit Karma, and by a wide margin. They’re estimated to have around 80 million customers. Those numbers appear starkly different at first glance, but it’s important to keep in mind LendingTree is relatively new, launching in 2014. Credit Karma developed a more captive relationship with customers from their inception in 2007, beginning as a free credit score platform. They’re effectively in an arms race, trying to emulate each other’s primary value propositions in order to win over a larger share of customer attention.

By all accounts, the My LendingTree product is still in its infancy. Personal loans make up nearly two-thirds of revenue generated through My LendingTree. Credit cards were integrated through CompareCards earlier this year; deposits will be integrated in the fourth quarter through DepositAccounts. As the platform more formally integrates mortgage refinancing and HELOCs, there are more channels to drive user engagement.

For the consumer, this app reinforces the aggregation and connection between interested borrowers and willing lenders. Arguably more significant, however, is the personalization of individual customer experience that will drive further engagement and improve the recommendation engine. With the continued migration to online and mobile for financial services, this product benefits from natural demographic tailwinds.

If LendingTree can successfully reengage with customers on a more recurring basis via My LendingTree, the app should be accretive to overall variable marketing margin because they’ll have to spend far less on promotional activities due to organic customer. The combination of a market-leading aggregator with a comprehensive PFM tool creates a flywheel effect where success begets success, particularly with a major head start in the lending aggregation business.

Removing the Informational Asymmetry

In LendingTree’s business model, customer demand drives the flow of ad dollars and ultimately origination volume. Lenders follow customer demand. LendingTree helps expedite that process. Lenders can expand their conversions by boosting the number of high-quality leads and reducing obstacles to the loan application process. LendingTree improves both catalysts.

On the lender side, My LendingTree fundamentally changes LendingTree’s value proposition. They used to be responsible for connecting lenders with warm leads to drive conversions. With an existing customer base, the lead generation suddenly gets easier. It also significantly reduces the customer acquisition cost for lenders, notoriously a major component of their expense profile.

Nearly 50% of all consumer interactions with banks and financial services companies occur online. It’s not controversial to say that figure is likely heading in only one direction. Currently, credit cards and personal loans are the most automated online application processes because the decisioning occurs relatively quickly. Of the expansive network of mortgage lenders on LendingTree’s platform, only 40 currently enable borrowers to continue their application online. As mortgages and small business loans become more automated through partnerships with third-parties like Blend and Roostify, LendingTree will benefit from more seamless integrations and likely, higher conversions.

The real value proposition for the lender, however, is in the headcount consolidation. Just as the number of stock brokers and equity traders has diminished significant, the role of the loan officer will follow a similar trajectory. LendingTree initially supplemented loan officers in their borrower sourcing from a marketing perspective, which drove loan officer commissions down significantly.

Doug Lebda’s next conquest is to supplant the entire sales function. In response to a question about LendingTree’s impact on lender headcount, Lebda responded: “what will happen is [lenders will] be able to reduce commission. So the real competitor, if you will, to LendingTree…is the fully commissioned loan officer…In the future, you’re going to have LendingTree convincing the borrower through technology and then you’re going to have an individual lender just basically processing and getting it through.”

The relationship between a loan officer and a prospective borrower is marred by informational asymmetry. Incentives aren’t aligned. Soon enough, the pre-approval process launched through their new digital mortgage experience, “Rulo” will help to solve a problem that has plagued LendingTree since its inception: an exhaustive pursuit from loan officers.

With Rulo, LendingTree sorts and filters the list of offers and provides a recommendation based on the best option. Then, the app allows you to contact the lender directly, offering the consumer the freedom they historically haven’t had. Commenting on the early success of the new experience, Lebda said “[the conversion rate is] literally about triple what it is on the LendingTree experience.” LendingTree is streamlining a low value, yet operationally costly element of the lending business that has remained more or less stagnant for half a century.

Seeing the Forrest through the Trees

The fawning over fintech companies has driven exorbitant amounts of global investment from venture capitalists and private equity firms who are ultimately looking for exit opportunities. Two things are happening: first, most of the major fintech companies aren’t going public, although that is beginning to change. Second, and perhaps more importantly, the ones that do go public don’t fare particularly well.

The tried and true strategy of most emerging financial technology startups is to focus on user growth and monetize later. LendingTree did the opposite; they created a cash-flow generating platform that served a critical purpose, simplifying a historically complex landscape for consumers, while simultaneously driving directly attributable revenue for lenders. They have proved their original value proposition, connecting borrowers with lenders, and now they’re playing catch up to provide supplementary tools to add more value for customers. It’s a rare pathway, but a productive one that more fintech startups should consider.

from TechCrunch https://ift.tt/2MdyUBK

No comments:

Post a Comment