Uber, the transportation-on-demand behemoth, today filed its much-anticipated updated S-1 today where it announced that it would be pricing its initial public offering at $44-50 per share.

Selling 180 million common shares, Uber plans to raise between $7.9 billion and $9 billion ahead of its public debut on the NYSE, valuing it at $84 billion — squarely in the middle of the $80-90 billion that was projected as late as yesterday. With the greenshoe, shareholders selling shares in the IPO, it could raise as much as $10.4 billion.

Separately, there were two surprise announcements in the S-1. First, PayPal said it would make a $500 million investment in the company in a private placement, as part of an extension of the partnership between the two, where they will develop new digital wallet services. Secondly, Uber said it expects to post a loss of between $1 billion and $1.1 billion for the first quarter of this year, a huge swing from net income of some $3.7 billion a year ago.

PayPal has been working with Uber providing payment services since 2013 and is its lead processing partner in the US and Australia (but not the only one globally).

This is the second big pre-IPO investment that Uber has announced this month. Last week, it announced a strategic $1 billion investment from SoftBank, Toyota and auto parts maker Denso, which valued the company at $7.25 billion.

The $500 million placement is being made at the same valuation as the IPO price range, Uber said.

“In April 2019, we entered into a stock purchase agreement with PayPal, Inc. (“PayPal”), pursuant to which PayPal will purchase $500 million of our common stock from us in a private placement at a price per share equal to the initial public offering price,” Uber notes. “The sale of the shares in the private placement is subject to certain closing conditions, including the closing of this offering and certain regulatory approvals. Concurrently, and subject to the closing of the private placement, we and PayPal extended our global partnership through the execution of an addendum to our existing commercial agreement. We and PayPal intend to explore future commercial payment collaborations, including the development of our digital wallet.”

“This is another significant milestone on our journey to be a platform partner of choice, helping to enable global commerce by connecting the world’s leading marketplaces and payment networks,” said PayPal president and CEO Dan Schulman in a statement. The is the second-biggest investment ever made by PayPal since its eBay spinout. The biggest is MercadoLibre in Latin America, in which PayPal invested $750 million in March.

In addition to the 180 million shares in the IPO, Uber notes that the underwriters have the option to purchase up to an additional 27 million shares of common stock from the selling stockholders solely to cover over-allotments, if any.

Additionally, Uber notes that it requested the underwriters to reserve up to 5.4 billion shares — three percent of the 180 million — through a directed share program to certain qualifying Drivers in the United States.

Bumpy and long road ahead

Uber’s pricing is more than three times the amount of Lyft’s $2.34 billion IPO, making it one of the largest IPOs in the U.S. since Alibaba’s debut on the public markets in 2014.

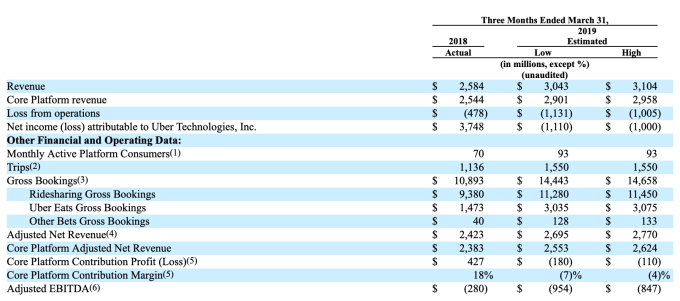

But the company has a long road ahead of it in its efforts to bring the business into profitability. The S-1 contains preliminary figures for the most recent quarter that ended March 31, and in them Uber said it expects its net income to be a net loss, with the range of between negative $1 and $1.11 billion. As a point of comparison, Uber’s positive net income in the same period a year ago was $3.748 billion.

Uber noted that the “expected net loss” came from several areas. First and foremost it’s spending a huge amount of money on what it describes as incentives and promotions — that is, offers both to drivers to keep working for Uber rather than, say, Lyft; and for passengers to continue riding with Uber — marketing in the face of heavy competition from Lyft and a variety of local competitors in other markets.

On top of that, Uber noted that the positive bump in the quarter a year ago came from its sales of operations in Southeast Asia (to Grab) and Russia (to Yandex), plus an unrealized gain of $2 billion on an investment in Didi.

“Our incentive and promotion spend varies widely from period to period and within various markets based on competitive dynamics and other factors,” Uber notes. It doesn’t note exactly what these dynamics factors might be, but they potentially include spend levelled by competitors for the same ends, as well as seasonal surges that might bring about specific promotions, and so on.

Uber also noted that monthly active platform consumers went up to 93 million from 70 million a year before, while revenues were up to between $3 billion and $3.1 billion, versus $2.6 billion a year ago.

In 2018, Uber reported 2018 revenues of $11.27 billion, net income of $997 million and adjusted EBITDA losses of $1.85 billion. Uber, which filed for its IPO two weeks ago, will list on the New York Stock Exchange in May.

More to come.

from TechCrunch https://tcrn.ch/2vpaHCg

No comments:

Post a Comment